Highly Rated

Mortgage Broker in Kingston

Our experienced mortgage broker in Kingston is here to understand and meet your specific needs. Explore your options today.

481+

200+

5000+

Leading Mortgage Broker in Kingston - Our Range of Products

At Mortgage Squad, we pride ourselves on being the leading mortgage brokers in Kingston. Our team of experts have years of experience in the industry and are dedicated to providing our clients with personalized and tailored solutions for their specific needs.

We offer a wide range of mortgage products to suit every individual’s unique financial situation. From first-time home buyers to seasoned investors, we have options that cater to everyone. Some of our top-rated products include first and second mortgage, refinancing, debt consolidation, home equity line of credit, renewal, private and self employed mortgage, and more.

With access to multiple lenders and competitive rates, we are confident in finding the best mortgage solution for each of our clients. Our services are available for the residents of Peterborough, Hamilton, Kitchener, North Bay, Brantford and surrounding areas.

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

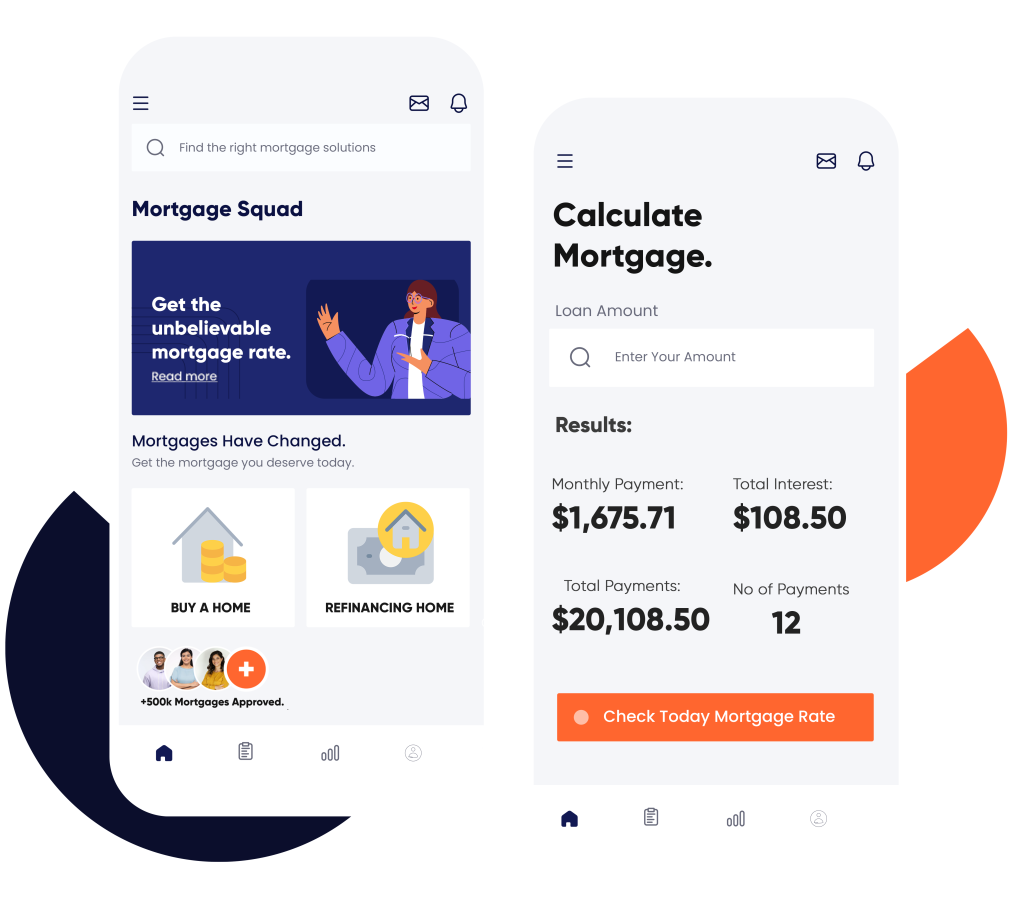

Take Advantage of Our Mortgage Calculator and Pre-Qualification Services

To further assist our clients in their mortgage journey, we offer a user-friendly mortgage calculator to help you estimate your monthly payments, determine affordability, and analyze various mortgage scenarios. Additionally, our pre-qualification service is designed to simplify the home buying process by helping you understand your borrowing capacity and budget range. By utilizing these tools, you can enter the real estate market with confidence, knowing exactly what to expect financially. Our team is here to support you every step of the way, ensuring a seamless and informed mortgage experience.

Calculate Your Costs Instantly

What Makes Us the Top Mortgage Broker in Kingston?

Our team of experienced mortgage professionals has a deep understanding of the local market and can provide valuable insights and advice to our clients. We are committed to offering exceptional customer service, building strong relationships with our clients, and going above and beyond to meet their needs.

We Work for You, Not the Lender

As an independent mortgage broker in Kingston, we work for you, not the lender. This means that our priority is finding the best mortgage option for you, not promoting a specific lender’s products. We have access to a vast network of lenders and can negotiate competitive rates and terms on your behalf. Our goal is to save you time, money, and stress by handling all the details of your mortgage application and ensuring that you receive the best deal possible.

Find out the differences between mortgage brokers and banks.

Expertise in Various Mortgage Types

Whether you are a first-time homebuyer or looking to refinance your current mortgage, our team has expertise in various types of mortgages. We can help you navigate through the different options and find the one that best suits your needs. We also specialize in alternative financing solutions for clients with unique financial situations. Whatever your home loan needs may be, we have the knowledge and resources to guide you towards a successful outcome.

Wide Network of Lenders and Resources

We have built strong relationships with a wide network of lenders, both traditional and alternative, including b lenders in Ontario, to ensure that our clients have access to the most competitive rates and terms. We also have connections with other professionals in the real estate industry, such as lawyers, appraisers, and home inspectors, which allows us to provide a comprehensive service to our clients. Our extensive resources give us an edge in finding the best mortgage solutions for our clients.

Personalized Approach

Streamlined Process

Applying for a mortgage can be a lengthy and complicated process. However, with our expertise and streamlined approach, we aim to make it as smooth and stress-free as possible for our clients. From initial consultation to final closing, we handle all the necessary paperwork and negotiations with lenders on your behalf. We also keep you updated every step of the way, so you are aware of any progress or changes in your application.

Pre-Approval Services

In addition to providing mortgage solutions for homebuyers, we also offer pre-approval services. This allows our clients to determine their budget and shop for homes with confidence. Our pre-approval process involves a thorough assessment of your financial situation, credit score, and debt-to-income ratio that can give you an advantage in the competitive housing market.

Get Approved

From Mortgage Broker in Kingston Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Our Agents

Mortgage Broker in Kingston - Zubair Afzal

Zubair Afzal is the Principal Mortgage Broker in Kingston & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Kingston, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.