Highly Rated

B Lender in Ontario

Our knowledgeable mortgage brokers in Ontario are dedicated to connecting you with the right B lenders in Ontario to meet your unique needs. Connect today to learn more.

481+

200+

5000+

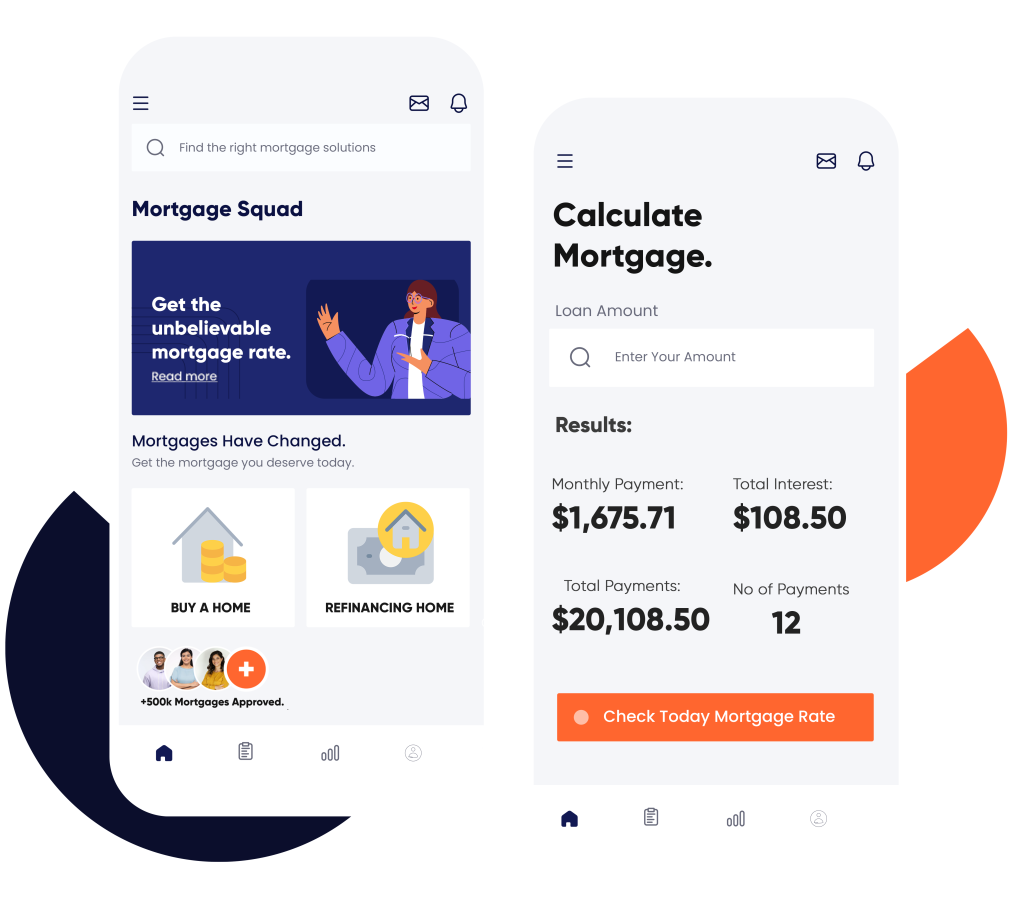

Apply For B Lender Mortgage in Ontario with Mortgage Squad

Many potential homebuyers may not be familiar with the term “B lender mortgage,” yet it plays an essential role in the mortgage landscape. B lenders, often referred to as alternative lenders, specialize in providing mortgage solutions for individuals who might not meet the strict requirements set by traditional banks.

These lenders adopt a more flexible approach to mortgage approval, making it feasible for clients with less-than-perfect credit scores, those who require self employed mortgage, or have unique financial situations to obtain the financing they require. This flexibility can be a game-changer for many aspiring homeowners.

Read More…

At Mortgage Squad, our team of experienced mortgage brokers can connect you with the right b lenders in Toronto for your specific needs.

At Mortgage Squad, we have a team of skilled mortgage brokers who are dedicated to helping you find the right B lenders in Toronto tailored to your specific needs. Use our calculator to determine your payments and reach out today to learn more. We understand the challenges you may face and are here to guide you through the process, ensuring you secure the home of your dreams. Interested? Apply Now!

Why Consider B Lenders in Toronto for Mortgage?

B lenders present several significant advantages compared to traditional lending institutions. First and foremost, they offer enhanced flexibility in evaluating your financial situation. Unlike banks, which often place a heavy emphasis on credit scores and income stability, b lenders take a more comprehensive approach. They consider the bigger picture, including factors such as your overall debt load, property value, and future earning potential. This assessment opens the door to mortgage qualification for a wider range of individuals, making homeownership accessible to many who might otherwise face rejection from conventional banks.

Moreover, b lenders frequently boast faster approval processes. Unconstrained by the stringent regulations that govern traditional banks, b lenders in Toronto can expedite your mortgage approval. This efficiency allows you to proceed with your home purchase swiftly and seamlessly, which is particularly beneficial in a competitive real estate market where timing is crucial. In essence, b lenders not only simplify the borrowing process, but also empower a broader audience to achieve their homeownership dreams.

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Our Role in Securing Mortgages From B Lenders in Toronto

Our team of experienced mortgage brokers is dedicated to helping you secure the best possible mortgage terms. We work closely with a network of reputable b lenders in Ontario, ensuring we can match you with the lender whose terms best suit your financial needs.

Using a mortgage broker like Mortgage Squad takes the guesswork out of the process. Instead of juggling multiple applications and meeting varying lender criteria on your own, our brokers handle all the legwork. We present your application to multiple b lenders, negotiate on your behalf, and streamline the entire process from start to finish.

Calculate Your Costs Instantly

Who Can Benefit from a B Lender Mortgage in Ontario?

A b lender mortgage can be a viable solution for a diverse range of clients. Here are some scenarios where alternative lending can make a significant difference:

- Self-Employed Individuals: Traditional banks often scrutinize self-employment income harshly. B lenders are more understanding of variable income streams and can offer flexible mortgage solutions.

- Clients with Poor Credit Scores: If your credit score has taken a hit due to past financial difficulties, b lenders are more willing to look beyond the score and consider your overall financial behavior. So if you need a bad credit mortgage, b lenders are the way to go.

3. New to Canada: New immigrants might not have an established credit history in Canada. B lenders can provide private mortgage options that accommodate these unique situations.

4. Home buyers with High Debt Levels: If your debt-to-income ratio is higher than what traditional banks prefer, b lenders can offer solutions that align with your current financial realities. Irrespective of your situation, you can apply for a first mortgage, second mortgage, and more with a b lender.

Regardless of your individual circumstances, B lenders can assist you in applying for a first mortgage, second mortgage, and more, making them an invaluable resource in the lending landscape.

Get Approved

From B Lenders in Ontario Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

How Can We Help Secure Mortgages From B Lenders in Toronto?

Our team of seasoned mortgage brokers is committed to helping you secure the most favorable mortgage terms available. We collaborate closely with a network of reputable B lenders across Ontario, allowing us to connect you with the lender whose terms align perfectly with your financial needs.

Choosing a mortgage broker like Mortgage Squad eliminates the uncertainty often associated with the mortgage process. Rather than struggling to manage multiple applications and navigate different lender criteria on your own, our dedicated brokers take care of everything for you. We present your application to a selection of B lenders in Ontario, negotiate on your behalf, and streamline the entire experience from start to finish. With our expertise and personalized approach, we aim to make your mortgage journey as smooth and straightforward as possible.

Rely on Us to Navigate You Through the Process

At Mortgage Squad, we take great pride in our client-first approach, placing your needs at the heart of everything we do. Our mission is to make home ownership not just a dream, but a reality for everyone, regardless of their financial background. We believe that securing a mortgage should be a straightforward and positive experience, free from unnecessary stress and confusion.

With our team’s expertise and unwavering dedication, we are committed to providing you with clear, concise information and tailored guidance at every step of your journey. We understand that navigating the mortgage process can be daunting, which is why we strive to empower you with the knowledge and support you need to make informed decisions. Let us help you achieve your home ownership goals with confidence!

Our Agents

Mortgage Broker in Ontario - Zubair Afzal

- LIC# M09001553

- 647-896-7674

- [email protected]

- Director

Zubair Afzal is the Principal Mortgage Broker in Ontario & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Ontario, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Contact Us

If you’re thinking about obtaining a b lender mortgage in Ontario, look no further than the experts at Mortgage Squad. Our team possesses extensive knowledge, valuable experience, and strong connections in the industry to help you secure the most favorable mortgage terms possible. We’re dedicated to turning your homeownership dreams into reality. Reach out to us today to discover how we can assist you in finding the ideal b lender mortgage solution tailored to your needs!

FAQs

Absolutely, B lenders can work with first-time homebuyers who may not qualify for a mortgage through traditional banks. They can provide more flexible terms and overlook certain financial shortcomings, making the dream of homeownership achievable even for those with non-traditional financial profiles.