Highly Rated

Mortgage Broker in Guelph

481+

200+

5000+

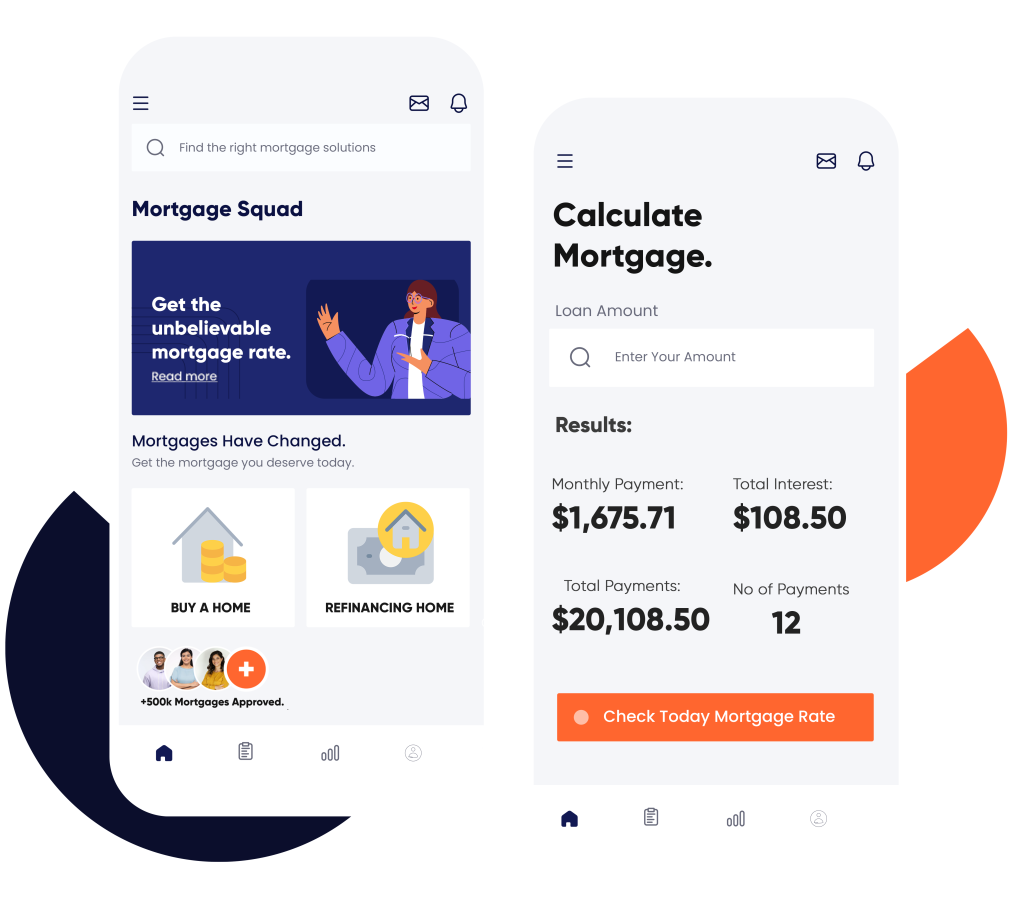

A Mortgage Broker in Guelph Providing Guidance for All Types of Properties

Our expert mortgage agents are dedicated to helping you secure the best mortgage rates and options available. We work closely with lenders on your behalf, allowing you to save thousands of dollars while streamlining the mortgage process.

As one of the leading mortgage brokers in Guelph, we provide you with the essential information you need to make informed decisions. By comparing rates from top financial institutions, we personalize your options to fit your unique needs. Our services not only save you time but can also lead to significant savings on your mortgage over the long term.

Ready to take the next step? Apply now with complete support from the best mortgage broker in Guelph today. Your dream home is within reach! Don’t forget to use our mortgage calculator to kickstart your journey!

When choosing a mortgage, you deserve trustworthy advice from experienced brokers. As committed professionals, we provide the detailed information you need to make informed decisions. Our knowledge of market trends, rates, and regulations allows us to offer valuable guidance, helping you pay off your mortgage faster and manage your debt more efficiently.

No matter the type of mortgage — whether you are a first-time homebuyer, looking for a second home mortgage, dealing with bad credit, require a vacation home mortgage, interested in private mortgage, or seeking mortgage renewal — we’re here to help. As a respected mortgage broker Guelph homeowners trust, we know the process can feel overwhelming, but you can count on us to support you every step of the way. We’ll handle all the intricate details, including negotiations with private lenders, to secure the best rates for you.

Since we are not tied to any specific lender or product line, we can customize our solutions to meet your unique needs. This flexibility allows us to compare rates from various lenders, helping you find the best option available. Our services are also accessible across Oakville, Etobicoke, Vaughan, Brampton, Ottawa and nearby cities.

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Why We Stand Out Compared to Banks and Other Brokerages

At our brokerage, we place the highest importance on transparency and honesty. We believe that fostering long-term relationships with our clients is key to success, which is why we take the time to understand your unique financial goals and tailor personalized solutions that meet your needs. Unlike larger banks or other brokerages driven by sales targets and commissions, our sole focus is on finding the mortgage option that works best for you.

Moreover, we pride ourselves on our accessibility. Our dedicated team is always available to address any questions or concerns you may have throughout the entire mortgage process. We recognize that navigating the world of mortgages can feel overwhelming, and we’re committed to making the experience as smooth and stress-free as possible. You can count on us to be your trusted mortgage broker in Guelph every step of the way.

Find out more about the differences between brokers and banks.

Calculate Your Costs Instantly

Reasons Why Guelph Homeowners Trust Us

- Experience: Our team has over 15 years of combined experience in the industry. We have helped numerous Guelph homeowners secure their dream home or refinance their current property. With our extensive knowledge and expertise, you can trust us to navigate any complex situations and find the best solution for your specific needs.

- Local Market Knowledge: As a local brokerage, we have an intimate understanding of the Guelph housing market. This allows us to provide valuable insights into market trends and help you make informed decisions about your financing options.

- Personalized Service: We understand that every homeowner’s financial situation is unique, which is why we take a personalized approach to each client. Our team will work closely with you to understand your goals and customize a solution that fits your specific needs.

- Access to Multiple Lenders: As an independent mortgage broker in Guelph, we have access to a wide range of lenders and products. This gives us the ability to shop around and find the most competitive rates and terms for our clients.

- Transparent Process: We believe in transparency, which is why we make sure our clients are fully informed throughout the process. From explaining all fees and charges to keeping you updated on the status of your application, we strive to maintain open communication and ensure complete understanding from start to finish.

Whether you’re a first-time homebuyer or looking to refinance your current mortgage, trust us to provide you with expert guidance and personalized service. Our team is dedicated to making the process as smooth and stress-free as possible, so you can focus on finding your dream home. Contact us today to learn more about our services and how we can help you achieve your homeownership goals.

Get Approved

From Mortgage Broker in Brampton Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Our Agents

Mortgage Broker in Barrie - Zubair Afzal

- LIC# M09001553

- 647-896-7674

- [email protected]

- Director

Zubair Afzal is the Principal Mortgage Broker in Barrie at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Barrie, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Get in Touch

Guelph is a lively community that supports families at every stage of life, providing something for everyone. Whether you already own a property or are contemplating a purchase and require the guidance of a mortgage broker in Guelph, contact us today to explore your options.

FAQs

Working with a broker has many benefits, including access to multiple lenders and products, personalized service, and expert guidance. A broker can also save you time and effort by shopping around for the best rates and terms on your behalf. Ultimately, it is up to individual preference, but consulting with a broker can greatly benefit those looking for a mortgage solution.

No, our services are available to all individuals looking for a mortgage solution, whether you are a first-time homebuyer or have previous homeownership experience. We are here to help guide you through the process and find the best option for your specific needs and goals.

Brokers have access to a wide variety of lenders and products, including those that may not be available to the general public. This allows them to negotiate on your behalf and potentially secure better rates and terms for your mortgage. Additionally, working with a broker can save you time and effort in searching for the best option.

Pre-qualification can give you a better understanding of your purchasing power and help set realistic expectations as you start looking for properties. It also shows sellers that you are serious and well-prepared to make an offer, giving you a competitive edge in the housing market. Pre-qualification can also speed up the mortgage approval process once you have found a property to purchase.

Yes, we work with clients from all financial backgrounds and strive to find solutions for those with less-than-perfect credit scores. While it may impact the types of mortgages and interest rates available to you, our team will work with you to find the best option possible given your credit situation. It’s always worth exploring your options and speaking with a broker, even if you have bad credit.

The specific documents required may vary depending on your individual circumstances and the type of product you are applying for. Generally, you will need to provide proof of income (such as pay stubs or tax returns), identification documents (such as a driver’s license or passport), bank statements, and information about any assets or debts you may have. Our team will be able to advise you on exactly what documentation is needed for your particular application.