Highly Rated

Mortgage Broker in Vaughan

Our experienced mortgage brokers in Vaughan are here to understand and meet your specific needs. Explore your options today.

481+

200+

5000+

Top Mortgage Brokers in Vaughan

We are proud to be a top mortgage broker in Vaughan, backed by over 15 years of industry expertise. Our strong relationships with a wide network of lenders enable us to present a diverse array of mortgage options tailored to your unique requirements. Our goal is to make your path to homeownership and financial security as straightforward as possible.

Whether you’re a first-time buyer or looking to refinance, require private mortgage or need help with bad credit mortgage, we offer dependable solutions that align with your financial aspirations. Try out our mortgage calculator and rely on Mortgage Squad for professional advice and support throughout the journey. Let us help you realize your dream home today.

As one of the leading mortgage brokers in Woodbridge, Vaughan, we offer comprehensive services to meet all your financing needs. Our team consists of highly knowledgeable and experienced professionals who work diligently to ensure that you receive the best possible solutions.

As experienced Vaughan mortgage brokers, we have successfully facilitated over 5,000 approvals, helping countless clients realize their homeownership dreams. Our expertise goes beyond merely securing loans; we are dedicated to delivering a seamless, comprehensive experience from start to finish.

What sets us apart as mortgage brokers in Vaughan is our vast network of lenders. This valuable network enables us to access rates and deals that are often not available through traditional channels. No matter the type of home financing you are interested in, be it self-employed mortgage, construction mortgage or need home loan options from b lenders, we are here to support you.

You can also reach out to us if you reside in Scarborough, Guelph, Newmarket, Barrie, Richmond Hill or surrounding areas. Contact us today to apply now!

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Products We Offer as Mortgage Brokers in Woodbridge

First Mortgage

Whether you’re entering the world of homeownership for the first time or looking to upgrade to a new residence, our first mortgage options offer competitive rates and flexible terms tailored to help you secure your dream home. We take the time to thoroughly assess your financial profile, ensuring that we connect you with lenders who best fit your unique needs and circumstances. Our dedicated team is here to guide you through the process, making it as smooth and stress-free as possible, so you can focus on creating wonderful memories in your new space.

Second Mortgage

If you’re looking for extra funds to cover renovations, education, or other expenses, our second mortgage options can provide the financial flexibility you need. By tapping into your home equity, you can access the resources necessary to reach your goals. Whether you want to enhance your living space, invest in your education, or manage unexpected costs, our tailored solutions are designed to help you achieve them with ease and confidence. Let us support you in unlocking the potential of your home!

Mortgage Renewal

As your mortgage term approaches its conclusion, our dedicated team is here to help you with the process of renewing your mortgage under the most favorable terms. We prioritize ensuring that you continue to take advantage of competitive rates while providing expert guidance through any changes in your financial circumstances. Whether you’re looking to adjust your payment structure or need advice on your options, we’re committed to supporting you every step of the way to secure the best deal available.

Mortgage Refinance

Are you interested in reducing your monthly payments or tapping into the equity of your home? Our refinancing options are designed to help you achieve your financial goals. Whether you’re looking to avoid high-interest rates, free up cash for other investments, or simply streamline your expenses, we’re committed to guiding you through every step of the process. Let us help you explore the best solutions tailored to your needs, so you can make the most of your financial future.

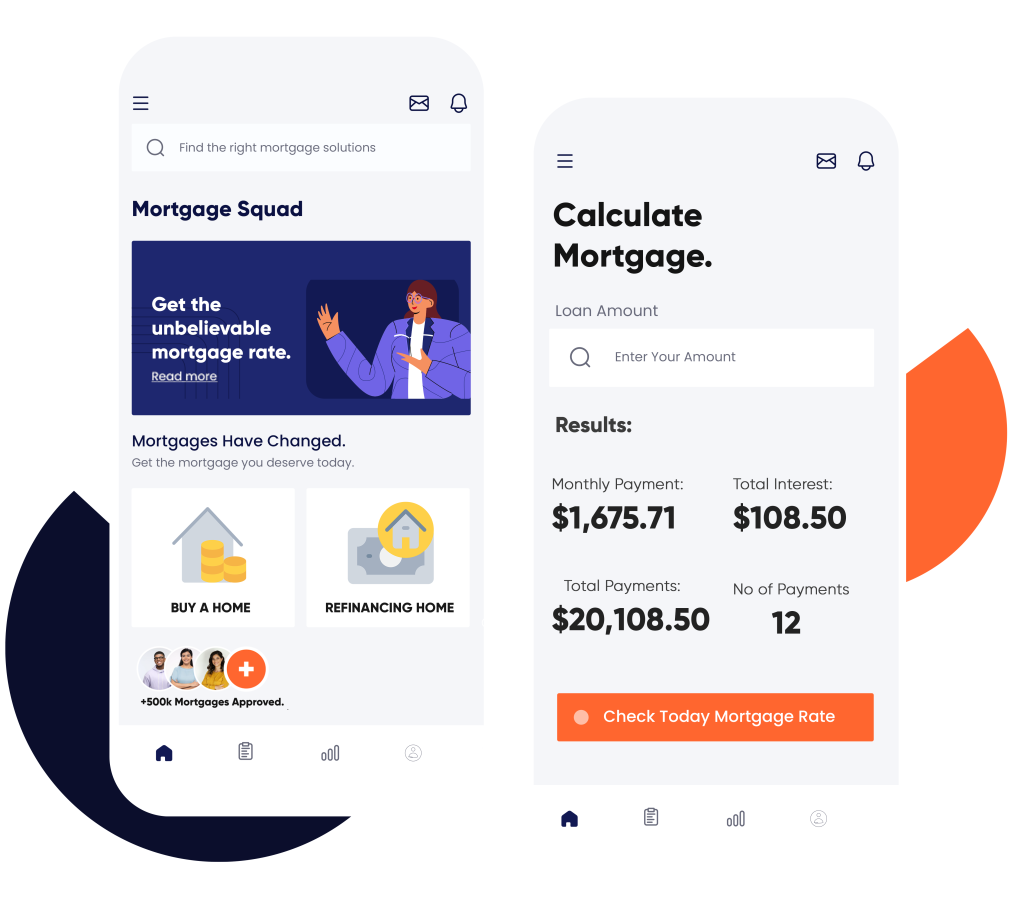

Mortgage Calculator

To support your decision-making process, we provide an easy-to-use mortgage calculator. This tool enables you to estimate your monthly payments and examine different scenarios, assisting you in discovering the best option that aligns with your budget and personal circumstances.

Private Mortgage

If you’re having difficulty obtaining a traditional home loan, we offer alternative solutions, including private mortgage options designed for those with unique financial circumstances. Our commitment is to provide access to funding, regardless of the challenges posed by conventional lending.

Calculate Your Costs Instantly

Why Choose Us as Your Mortgage Broker in Vaughan?

- Streamlined Paperwork: Navigating the process can often feel overwhelming due to the extensive paperwork involved. At Mortgage Squad, we take the hassle out of this experience by expertly managing all the complexities for you. Our goal is to provide a seamless and stress-free journey from start to finish, so you can focus on what truly matters — your new home.

- Pre-Approval Peace of Mind: As one of the most trusted Vaughan mortgage brokers, we recognize that the fear of mortgage denial can be daunting. That’s why our pre-approval process is designed to give you confidence and clarity. By assessing your financial situation up front, we minimize risks and guide you along the right path toward securing the financing you need, ensuring you feel supported every step of the way.

- Expertly Negotiated Terms: With our extensive network of trusted lenders, we are well-positioned to negotiate the best possible terms for your home loan. Our experienced team is dedicated to finding a plan that aligns perfectly with your unique financial goals and circumstances. This way, you can rest assured that you’re getting the most advantageous deal tailored just for you.

Personalized Solutions Tailored Just for You!

We aspire to be your preferred mortgage broker in Vaughan. Our mission is to simplify the process, making it seamless and stress-free for every client. We provide personalized service and expert advice tailored to your unique needs. Whether you’re a first-time homebuyer, looking to refinance, or renewing your current mortgage, our dedicated team is here to guide you through every step. Explore our comprehensive range of options designed to help you achieve your homeownership dreams today!

Get Approved

From Mortgage Broker in Vaughan & Woodbridge Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Our Agents

Mortgage Broker in Vaughan & Woodbridge - Zubair Afzal

- LIC# M09001553

- 647-896-7674

- [email protected]

- Director

Zubair Afzal is the Principal Mortgage Broker in Vaughan & Woodbridge & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Vaughan & Woodbridge, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Contact us Today

Are you ready to take the next step toward your financial future? Reach out to us today to schedule a consultation and embark on your journey to securing your home loan with Mortgage Squad. Your dream home is within reach!

FAQs

Affordability is determined by your income, expenses, and any existing debt. It’s crucial to assess your budget and keep in mind expenses like taxes, insurance, and maintenance. Working with our team can help you determine a realistic home-buying budget.

Refinancing involves replacing your existing home loan with a new one, usually to secure a lower interest rate, change the loan term, or access equity in your home. Our team can provide insights into when refinancing makes sense and guide you through the process seamlessly.

Your credit score impacts the interest rate you may receive, as well as your eligibility for certain products. Higher credit scores typically result in more favorable terms, so it’s beneficial to maintain a good credit history.

Yes, there are options for those with lower down payments, including first-time homebuyer programs. We can walk you through these options to find a solution that suits your needs.

Required documents generally include proof of income, tax returns, bank statements, and identification. Our team will provide you with a comprehensive checklist to ensure you have everything you need for a smooth application process.