Highly Rated

Mortgage Broker in Scarborough

Our experienced mortgage brokers in Scarborough are here to understand and meet your specific needs. Explore your options today.

481+

200+

5000+

The Products We Offer As a Mortgage Broker in Scarborough

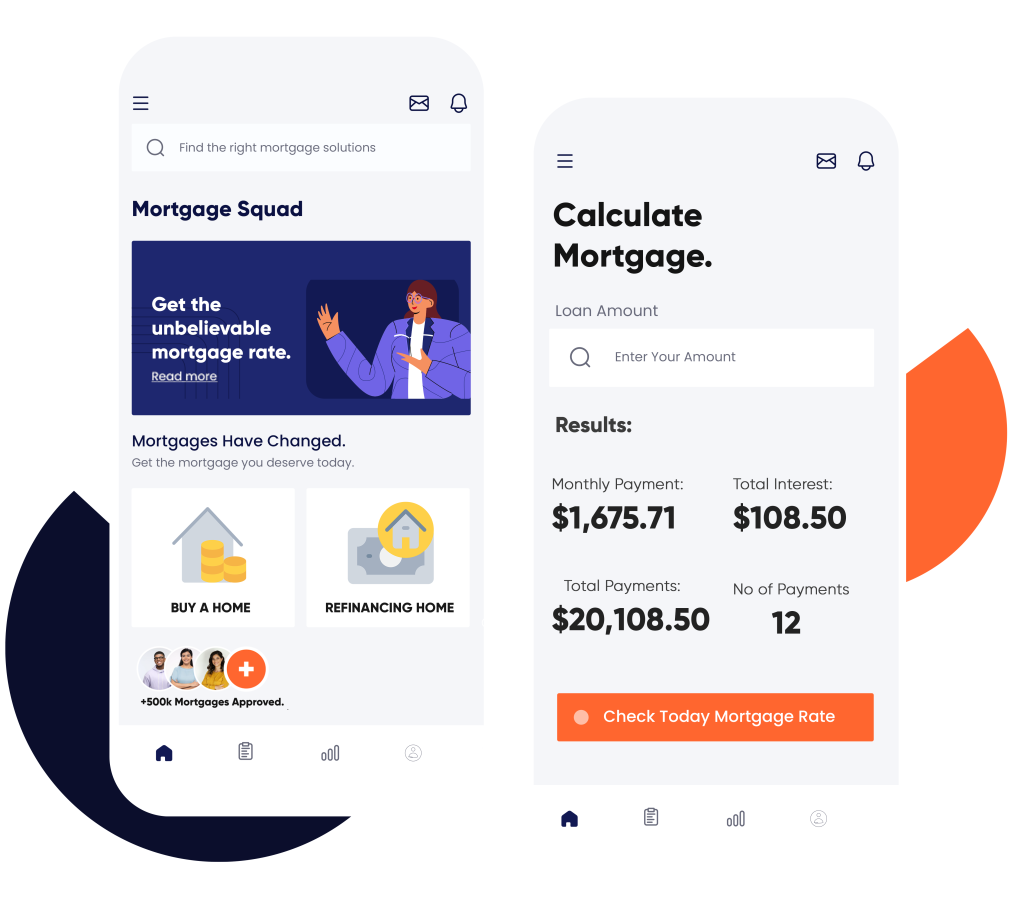

Welcome to Mortgage Squad, your trusted mortgage broker in Scarborough. We are dedicated to providing outstanding customer service, proudly reflected in our 5-star rating from over 200 Google reviews. Our commitment to excellence guarantees a fast, same-day response to all inquiries, establishing us as a top choice for clients in Scarborough.

With a 100% customer satisfaction rate, we help clients navigate one of the most significant financial decisions of their lives: securing the right home loan. Choose us for expert guidance and exceptional service in Scarborough. Get started with our mortgage calculator today.

We offer a comprehensive range of products to meet all your financing needs. Whether you’re looking to embark on your journey towards homeownership with a first mortgage or need assistance with a second home mortgage, our expert team is here to guide you every step of the way. For those considering refinance or renewal options, we provide tailored solutions that can help you secure the best rates and terms to suit your financial goals.

Our debt consolidation services are designed to streamline your monthly payments and reduce financial stress, creating a manageable path toward financial freedom. Additionally, for individuals interested in accessing their home’s equity, we offer competitive home equity lines of credit (HELOC) that provide flexible access to funds as needed.

Understanding that every client’s situation is unique, we also specialize in offering solutions for the self-employed and those with bad credit. Our personalized approach ensures that even with a non-traditional employment history or credit challenges, you still have viable options to secure financing. Moreover, our pre-qualification services allow you to gain a clearer picture of your borrowing potential, putting you in a stronger position when making offers on your desired property. You can also get in touch with us if you are residing in Ottawa, Mississauga, Brampton, Richmond Hill, Barrie or nearby cities.

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Why Clients Trust Us as Their Mortgage Broker in Scarborough

Assurance Against Denials

Streamlined Documentation, No Over commitments

We focus on helping you understand how much you can afford to borrow. Our experts provide personalized advice to prevent financial overreach and empower you to make informed decisions that align with your budget. We know that dealing with paperwork can be overwhelming, which is why we simplify the process for you. Let us handle all the documentation, ensuring you secure the mortgage you need without the hassle of excessive forms and bureaucracy. Trust our team for clear, expert guidance tailored to your financial needs.

Access to Multiple Lenders for Better Rates

Optimal Terms and Quick Processing

Calculate Your Costs Instantly

Our Range of Services

Customized Solutions

At Mortgage Squad, we provide customized solutions to fit your unique financial needs. Whether you’re looking for a first time home buyer mortgage, an interest only mortgage, a vacation home mortgage, or private mortgage, our experienced team is dedicated to offering competitive rates and personalized advice that can help you achieve your homeownership goals.

Comprehensive Mortgage Support

From pre-approval to closing, we are your trusted partner in the process. As a leading mortgage broker in Scarborough, we offer comprehensive support to ensure a smooth journey to homeownership. Our team is always available to answer your questions and address any concerns, making your experience seamless and stress-free.

Expert Advice

With over 15 years of industry expertise, our knowledgeable agents are skilled at navigating even the most complex transactions. Whether you’re a first-time homebuyer or an experienced investor, you can rely on our expert guidance to make informed decisions. Start your journey today by using our mortgage calculator to explore your options!

Quick & Reliable Service

Get Approved

From Mortgage Broker in scarborough Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Our Agents

Mortgage Broker in Scarborough - Zubair Afzal

- LIC# M09001553

- 647-896-7674

- [email protected]

- Director

Zubair Afzal is the Principal Mortgage Broker in Scarborough & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Scarborough , Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Get in Touch with us Today

Are you ready to take the next step towards homeownership? Contact Mortgage Squad, your reliable mortgage broker in Scarborough, and discover how we can help put you on the path to achieving your real estate dreams. With our expertise and unwavering commitment to excellence, you can place your trust in us to guide you through the mortgage process and into your new home.

Frequently Asked Questions (FAQs)

A broker can help you in several ways when buying a home in Scarborough. They can provide expert advice on different mortgage options and help you find the best rates for your specific needs. They can also assist with the application process and handle negotiations with lenders on your behalf. Additionally, they can save you time and effort by doing all the research and paperwork for you, making the entire process more efficient and stress-free.

Yes, absolutely! At Mortgage Squad, we believe that everyone deserves the opportunity to become a homeowner regardless of their credit score. We have access to alternative lenders who may be able to provide financing options for those with bad credit. Our team is dedicated to finding solutions for our clients and helping them achieve their homeownership goals.

While banks only offer their own mortgage products, brokers have access to a wide range of lenders and products. This means they can find the best rates and options for your specific needs. Additionally, brokers work for you, not the lender, so their main priority is finding the best solution for you. They also provide personalized and unbiased advice, unlike bank employees who may have sales targets to meet. Ultimately, using a broker gives you more options and support throughout the home buying process.

In addition to helping with obtaining financing for your home purchase, brokers can also assist with refinancing an existing mortgage or securing a second mortgage. They can also provide advice on credit repair and debt consolidation, as well as connect you with other professionals in the real estate industry, such as lawyers and home inspectors. Brokers are there to guide and support you through every step of your homeownership journey, making them a valuable resource for any homeowner or aspiring homeowner.

When applying for a mortgage, you will typically need to provide personal information such as your income, employment history, and credit score. You will also need to provide documentation such as pay stubs, tax returns, and bank statements. Your mortgage broker can help guide you through the application process and let you know exactly what documents are needed for your specific situation.