Highly Rated

Mortgage Broker in Etobicoke

Our experienced mortgage brokers in Etobicoke are here to understand and meet your specific needs. Explore your options today.

481+

200+

5000+

A Mortgage Broker in Etobicoke Offering Diverse Products

As the housing market continues to grow, many individuals find themselves overwhelmed by the intricate process of securing a mortgage. That’s where we step in. As an experienced and reliable mortgage broker proudly serving the Etobicoke community for many years, we’re dedicated to simplifying the process for our clients.

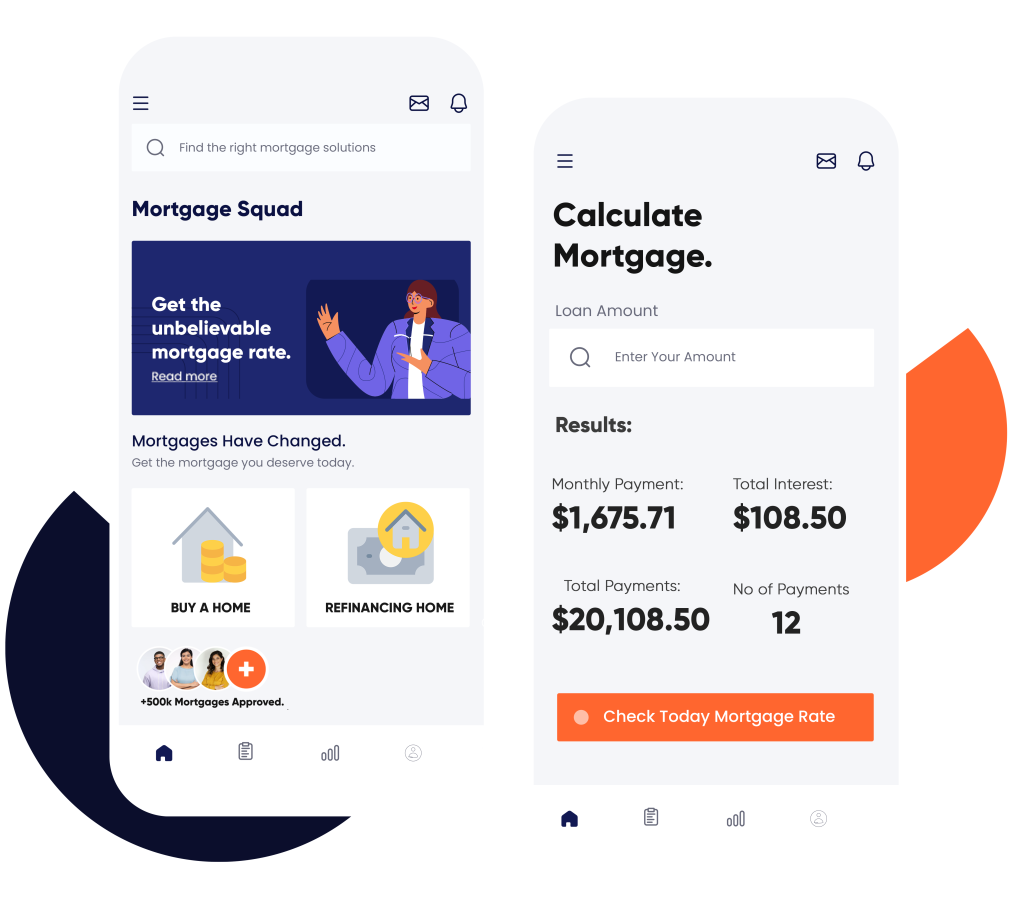

In addition to our personalized services, we offer a user-friendly calculator that helps potential homeowners estimate their monthly payments and overall affordability. Our pre-qualification services further streamline the process, giving clients a clear understanding of their budget before they start house hunting.

Our comprehensive array of services caters to various needs, whether you’re looking for a first mortgage to purchase your dream home or a second home mortgage to leverage your existing property’s equity. For the self-employed, we offer tailored solutions for those who are self-employed. Even if you have less than perfect credit, our bad credit mortgage options can help you explore available financing possibilities.

Additionally, we provide private mortgage alternatives for those looking for flexible, private lending arrangements. If you’re interested in managing your finances more effectively, consider our home equity line of credit (HELOC) offerings or debt consolidation solutions, designed to simplify your financial obligations and potentially lower overall interest costs. We can also help you acquire financing solutions from b lenders.

Our services are also available in Scarborough, Guelph, Windsor, Mississauga and other nearby cities.

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Why Choose Us?

We are on a mission to help individuals and families turn their homeownership dreams into reality with personalized solutions. What makes us different from other brokers? Here’s why you should choose us as your go-to mortgage broker in Etobicoke:

- Expert Team: Our crew is made up of seasoned professionals with deep expertise in the industry. We keep our finger on the pulse of the latest market trends and regulations, ensuring our clients receive top-notch advice and solutions.

- Tailored Service: We recognize that each client has unique financial goals and situations. That’s why we take a customized approach, modifying our services to fit your specific needs and circumstances.

- Diverse Lender Access: As an independent brokerage, we have a wide network of lenders, including major banks, credit unions, and private lenders. This diversity allows us to offer our clients competitive rates and adaptable mortgage options.

- Outstanding Customer Care: Client satisfaction is our top priority. Our team is committed to delivering exceptional service, going the extra mile to ensure a seamless and stress-free experience for everyone we work with.

- Complete Transparency: We believe in being fully transparent about our services. We ensure our clients are informed at every stage of the process and understand all the terms and conditions involved.

Our Services

Mortgage Pre-Approval

First-Time Homebuyer Assistance

Calculate Your Costs Instantly

Mortgage Renewals and Refinancing

When it’s time for renewal or if you’re thinking about refinancing, our team can help you discover the best rates and terms that suit your situation. We’ll also guide you on whether refinancing is a smart move for you and assist with the paperwork.

Debt Consolidation

Managing multiple debts can be overwhelming. Our debt consolidation services aim to streamline your finances by merging all your debts into a single monthly payment with a lower interest rate.

Second Mortgages

If you’re looking for a second mortgage, our expertise extends beyond traditional loans. We collaborate with a network of private lenders to secure the best options for your financial needs, even if you don’t qualify for a bank loan.

Get the Best Rates and Honest Guidance

With our extensive network of lenders across Canada, we help you get the most competitive rates. However, we go beyond just rates; we focus on matching you with the ideal mortgage product tailored to your specific requirements.

As a top mortgage broker in Etobicoke, we provide unbiased advice without any obligation to recommend a specific solution. This ensures that your mortgage aligns perfectly with your financial goals. Ready to take the first step? Check out our mortgage calculator to estimate your payments!

Get Approved

From Mortgage Broker in Etobicoke Hill Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Our Agents

Mortgage Broker in Etobicoke - Zubair Afzal

- LIC# M09001553

- 647-896-7674

- [email protected]

- Director

Zubair Afzal is the Principal Mortgage Broker in Etobicoke & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Etobicoke, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Get Started today

Are you in search of a trustworthy mortgage broker in Etobicoke? Look no further! Our experienced team has successfully guided numerous Etobicoke residents through the process, helping them discover the perfect solution tailored to their unique needs. Whether you’re a first-time homebuyer or considering refinancing, we are dedicated to assisting you every step of the way. Let us collaborate to turn your homeownership dreams into reality! Contact us today to begin your journey!

FAQs

Using a broker can be beneficial for several reasons. A mortgage broker has access to a network of lenders, which means they can offer you more options and potentially better rates compared to going directly to a bank. They also have expertise in finding the right product tailored to your specific needs and can provide unbiased advice without any obligation to recommend a specific solution.

The required documents may vary depending on your situation, but some common ones include proof of income, employment verification, credit report, bank statements, and identification. It’s best to consult with a mortgage broker or lender for a complete list of required documents.

While it may be more challenging to get a second mortgage with bad credit, it is not impossible. A broker can help you assess your options and find a lender who may be willing to work with you. Keep in mind that you may need to pay a higher interest rate or provide additional collateral for the loan.

Yes, there are several ways to pay off your mortgage faster, such as making lump-sum payments or increasing your regular payment amount. It’s best to consult with a broker or lender to discuss your specific situation and determine the best strategy for paying off your mortgage sooner. Additionally, some lenders may have prepayment penalties, so it’s essential to review your mortgage terms before making any extra payments.

A pre-approval is an estimate of how much money you can borrow from a lender based on your current financial situation. It involves providing documentation and undergoing a credit check. A pre-approval can give you an idea of what price range you should be looking at when house hunting and can also make your offer more attractive to sellers as it shows that you are a serious buyer who has already taken steps towards securing financing. Keep in mind that a pre-approval is not a guarantee of getting a mortgage, as the lender will still need to review your application and verify all information before giving final approval.

A mortgage rate is the interest rate charged by a lender on a home loan. This rate can vary depending on factors such as the type of loan, credit score, down payment amount, and current economic conditions. A lower rate can result in lower monthly payments and less interest paid over the life of the loan.