Highly Rated

Mortgage Broker in Newmarket & Aurora

Our experienced mortgage brokers in Newmarket & Aurora are here to understand and meet your specific needs. Explore your options today.

481+

200+

5000+

Premium Services From a Mortgage Broker in Aurora

Navigating the mortgage process can be tricky, but having the right partner by your side makes all the difference. We bring over 15 years of expertise as the top mortgage broker in Newmarket, ready to support you with every aspect of your journey. Whether you need a private or first mortgage, refinancing, renewal, or options for bad credit or self-employed individuals, our knowledgeable team is committed to delivering outstanding customer service and competitive rates.

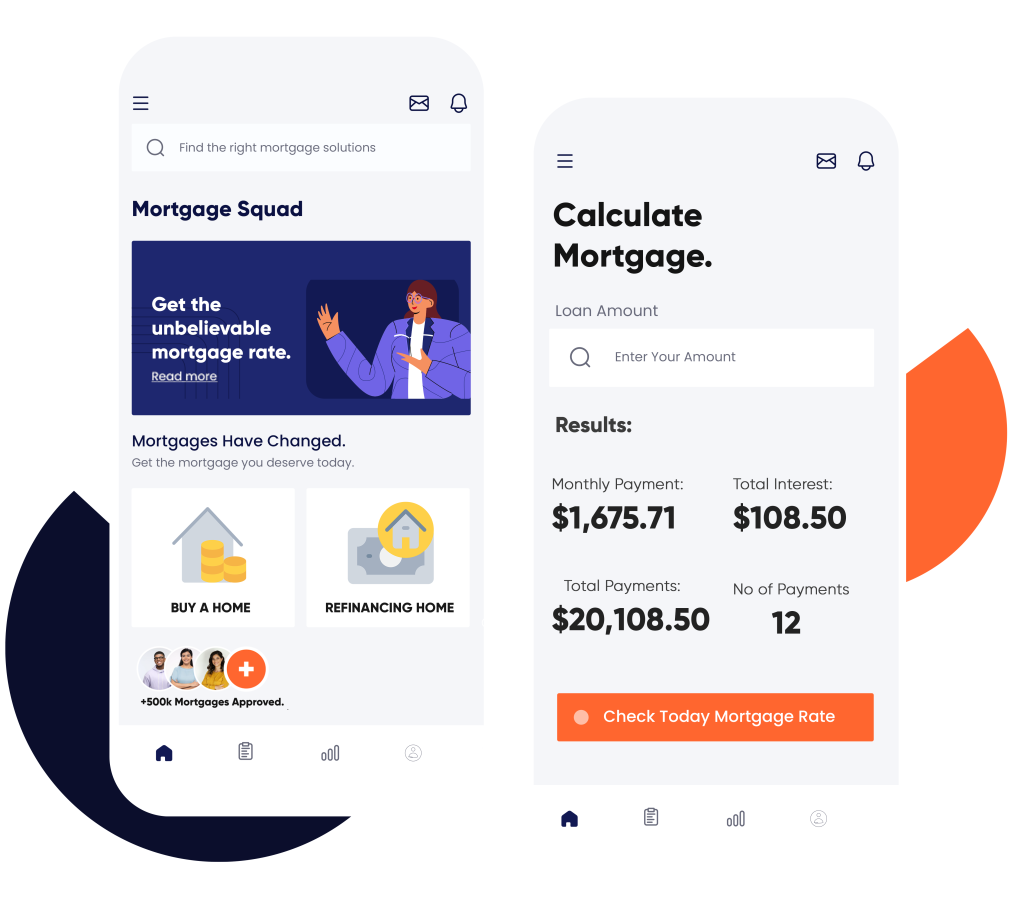

Don’t forget to check out our mortgage calculator to estimate your payments and see how we can help turn your homeownership dreams into reality!

We recognize that each client’s financial situation is distinct, which is why we are committed to providing personalized solutions tailored to your specific needs. As a leading mortgage broker in Aurora, we strive to go the extra mile, ensuring you secure the best rates available while simplifying the entire mortgage process for you.

Our extensive range of services is designed to help you discover the perfect solution. The services we offer include First Mortgage, Refinancing, Renewals, Private Mortgages, Bad Credit Mortgage, Self-Employed Mortgage, and Second Home Mortgages. We also specialize in Vacation Home Mortgage, Debt Consolidation and Home Equity Line of Credit (HELOC).

At every step of the process, our team will work closely with you to understand your financial situation, goals, and preferences. Trust us to provide the support you need as you navigate the mortgage landscape. Explore our comprehensive services today and take the first step towards achieving your financial goals. You can also reach out to us if you are a resident of Scarborough, Newmarket, Richmond Hill, Vaughan or nearby cities.

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Reasons to Choose Mortgage Squad as Your Mortgage Broker in Newmarket

Outstanding 5-Star Rating on Google

Our dedication to excellence is evident in our stellar 5-star rating on Google, bolstered by more than 200 enthusiastic reviews from satisfied clients. We take great pride in delivering exceptional customer service, ensuring that you receive prompt, same-day responses to all your inquiries. Our priority is always our clients, which allows us to create a seamless and well-informed experience throughout the process. When you choose us as your mortgage broker in Newmarket needs, you’ll understand why so many clients rely on us for dependable and efficient service.

Guaranteed 100% Customer Satisfaction

Selecting us as your mortgage broker in Aurora not only secures you access to expert services but also guarantees a 100% customer satisfaction rate. Our dedicated team goes the extra mile to ensure that each client receives personalized solutions tailored to their unique circumstances. With over 5,000 mortgages approved and a wealth of experience, our team is skilled at handling even the most complex situations. Whether you’re self-employed with fluctuating income or have a credit history that isn’t perfect, we have the expertise and resources to tackle any challenge and find practical, effective solutions that meet your needs.

Pre-Qualification Services for Clients

We understand that the application process can be daunting and overwhelming, especially for first-time homebuyers. That’s why we offer pre-qualification services to help you determine how much you can afford to borrow before you start shopping for a new home. Our team will assess your financial situation, including income, credit score, and debt-to-income ratio, to provide an accurate estimate of your budget. This service allows you to set realistic expectations and avoid wasting time looking at properties that are outside of your price range.

We Will Find the Best Mortgage Terms for You

When it comes to securing financing for your home, working with us gives you a significant edge. One of our standout advantages is our ability to negotiate competitive rates for our clients. Leveraging a vast network of lenders, including major banks, credit unions, and private lenders, we are well-equipped to advocate for the best possible terms tailored to your needs.

Our expert team stays on top of the latest market trends and lender offerings, ensuring you’re informed and positioned to take advantage of the most favorable rates and conditions. Whether you’re looking for a fixed-rate mortgage for stability or a variable-rate option for potential cost savings, we work tirelessly to identify the perfect solution that aligns with your financial goals and budget.

With over 15 years of experience as a mortgage broker in Newmarket and Aurora, we understand that the process can be challenging. That’s why we are dedicated to guiding you every step of the way, making the experience as smooth and stress-free as possible. Trust us to help you navigate today’s competitive market and secure the most advantageous options available for your future. Your dream home is within reach, and we’re here to make it happen!

Professional Mortgage Brokerage Services in Aurora

At Mortgage Squad, we recognize that each client has unique mortgage needs. Whether you’re a first-time homebuyer, refinancing your current mortgage, or seeking a mortgage renewal, we’re here to help. With an excellent reputation as a premium mortgage broker in Newmarket, our team offers expertise in a variety of mortgage products tailored to your specific situation. Explore our comprehensive services to find the right mortgage solution for you. Trust us to provide personalized support every step of the way!

Our services includes First Mortgage, Mortgage Refinancing, Mortgage Renewals, Private Mortgages, Bad Credit Mortgages, Self-Employed Mortgages, and Second Home Mortgages.

Our team will work closely with you to understand your financial situation, goals, and preferences, ensuring that you receive personalized advice and the most suitable mortgage solution.

Calculate Your Costs Instantly

Our Agents

Mortgage Broker in Newmarket - Zubair Afzal

- LIC# M09001553

- 647-896-7674

- [email protected]

- Director

Zubair Afzal is the Principal Mortgage Broker in Newmarket & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Newmarket, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Get Approved

From Mortgage Broker in Newmarket & Aurora Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Get Started today

FAQs

Interest rates determine how much you’ll pay over the life of your mortgage. Lower rates result in lower monthly payments and less interest paid over time, whereas higher rates increase both.

Pre-approval is an evaluation by a lender that determines your loan eligibility and estimate of the amount you can borrow. It provides a clearer picture of your buying power and can enhance favorability with sellers.

Lenders evaluate your credit score, income, debts, employment history, and the value of the property to ensure your financial stability and ability to repay the loan.