Highly Rated

PRIVATE MORTGAGE IN MISSISSAUGA

Looking for flexible financing options? Contact us today to learn more about securing your private mortgage in Mississauga!

481+

200+

5000+

What is a Private Mortgage?

A private mortgage is a loan funded by an individual or group rather than a traditional financial institution like a bank or credit union. These loans are often used for short-term financing needs and can be secured by residential or commercial properties.

Those who have been rejected by a traditional lender or are unable to meet their strict lending criteria can turn to private mortgage lenders for funding. These are best for people with bad credit or those who are self-employed. Private mortgages offer more flexibility and leniency in terms of credit score requirements, income verification, and property type. They also have faster approval processes compared to traditional lenders.

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Why Secure a Private Mortgage?

Opting for a private mortgage in Mississauga can be appealing for several reasons. Individuals with poor credit or those who are self-employed often encounter hurdles when applying for traditional bank mortgages. Low credit scores or past bankruptcies can complicate the mortgage approval process, but private lenders tend to be more flexible, offering necessary financing to these individuals. Similarly, conventional lenders demand proof of consistent income, which can be difficult for self-employed people or those with atypical income streams. In such scenarios, private lenders provide greater flexibility in their criteria, making it feasible for these individuals to secure a mortgage.

Private mortgages also come with benefits like faster approval times and adaptable loan conditions. They can be processed and approved more quickly than standard loans, which is advantageous for those in need of rapid funds, such as for buying or renovating properties. Unlike traditional mortgages, private loans are not constrained by rigid regulations, allowing for more customizable agreements between borrowers and lenders. Additionally, private mortgages create investment opportunities, enabling lenders to diversify their portfolios by earning interest, often achieving higher returns than conventional investment avenues.

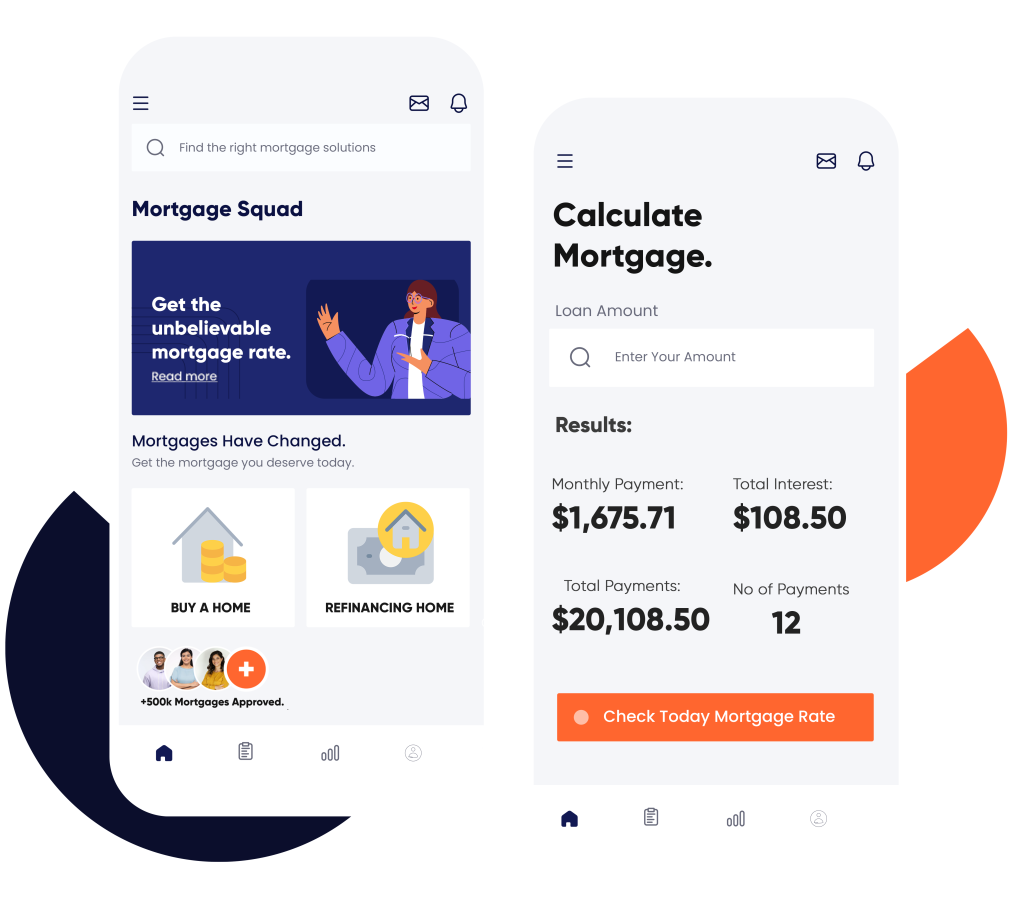

Calculate Your Costs Instantly

Why Choose Mortgage Squad for Private Mortgage in Mississauga?

Quick Access to the Best Mortgage Rates

Discover highly competitive mortgage rates swiftly and easily, saving you money and finding the best fit for your ideal home. Our efficient process links you with leading lenders, offering personalized options suited to your financial goals.

Get Pre-Qualified with Ease

Kickstart your home-buying adventure by getting pre-qualified effortlessly. This step helps you grasp your budget and prepare for the exciting journey of finding your perfect home.

Effective Budget Planning with Our Mortgage Calculator

Utilize our user-friendly mortgage calculator to plan your payments strategically and manage your budget effectively. This tool empowers you to make informed decisions and stay aligned with your financial aspirations.

Simplified Paperwork Solutions

Tackle paperwork with ease using our streamlined solutions, crafted to simplify and clarify each phase, ensuring a straightforward and stress-free experience.

15+ Years of Experience, 5,000+ Approved Mortgages

Mortgage Squad brings decades of experience in the mortgage industry, offering invaluable insights and expertise to guide you toward the best solutions.

Reduced Risk of Denial

Rest assured with our reliable services, specifically designed to lower the chances of mortgage denials. Our expert team guides you throughout the process, fortifying your application and boosting approval rates. Trust us to accompany you every step toward securing your dream home.

From accessing the best rates quickly to reducing denial risks, we provide clarity and support each step of the way. Our tools and expertise streamline the process, allowing you to focus on achieving your homeownership dreams with assurance. We can also help you with first, second, and vacation home mortgage, debt consolidation, mortgage refinancing and renewal, home equity line of credit, and more.

How Can Mortgage Squad Assist in Making Mortgage Decisions?

Securing home financing can be daunting, particularly for those concerned about overextending their budget. At Mortgage Squad, the top mortgage broker in Toronto, we focus on safeguarding your financial well-being. We provide tailored advice to ensure you find a mortgage that aligns with your budget seamlessly.

Our expert team is dedicated to walking you through the mortgage journey. We take the time to assess your financial circumstances, lifestyle, and long-term goals, empowering you to make informed decisions. Our mission is to clarify the distinctions between private and traditional mortgages, helping you secure your dream home without compromising financial stability. With our guidance, you can apply for a private mortgage in Mississauga with confidence, knowing you have a reliable ally at your side.

Benefits of Partnering with a Private Lender in Mississauga

Choosing a private lender in Mississauga offers several benefits for securing a mortgage. Unlike traditional banks, private lenders cater to individuals with imperfect credit or unconventional income by offering flexible lending criteria, making mortgage qualification easier. Their rapid approval process ensures quicker decisions, which is vital for those needing swift responses.

Lenders of private mortgage in Mississauga also offer personalized solutions tailored to the borrower’s specific financial needs, such as interest-only or balloon payment options. They simplify the application process with minimal documentation, easing the burden on borrowers. With higher approval rates, private lenders are a viable option for individuals with unique financial backgrounds aiming to secure a mortgage.

How to Find a Private Mortgage Lender in Ottawa

If you’re seeking advice on private lending, consider starting with Mortgage Squad. Our team specializes in connecting clients with the ideal private lenders, leveraging extensive expertise to help secure favorable mortgage terms. By consulting with us, you receive personalized guidance tailored to your unique financial situation and mortgage requirements.

From your initial inquiry through to the completion of your loan, our experienced advisors provide comprehensive support, ensuring you remain informed and at ease throughout the process. Our dedication to transparency and customer success makes us a dependable ally in your homeownership journey. Whether you reside in Ottawa, Vaughan, Barrie, Hamilton, or elsewhere, Mortgage Squad can streamline the process of finding a private mortgage lender.

Get Approved

From Mortgage Broker in Mississauga Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Our Agents

Mortgage Broker in Oakville - Zubair Afzal

- LIC# M09001553

- 647-896-7674

- [email protected]

- Director

Zubair Afzal is the Principal Mortgage Broker in Oakville & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Oakville, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Contact Mortgage Squad Today

Are you ready to explore your private mortgage options? Contact Mortgage Squad today to learn more about how we can assist you. Our team of experts is prepared to provide the guidance and support you need to secure a mortgage from a private lender in Mississauga. Let us help make your homeownership dreams a reality.

FAQs

Private lenders typically have more flexible lending criteria than traditional banks, and may approve borrowers with credit scores below 600. However, having a higher credit score can still increase your chances of securing favorable terms and interest rates.

Private lenders usually require less documentation compared to traditional lenders. However, you will still need to provide proof of income, such as pay stubs or tax returns, as well as details about your assets and liabilities. It’s always best to consult with your private lender or mortgage broker for specific requirements.

The approval process for a private mortgage can be much quicker than with traditional lenders, often taking only a few days. This is because private lenders are more focused on the value of the property being mortgaged rather than the borrower’s credit history. However, this may vary depending on individual circumstances and the complexity of the loan.

Private mortgages can be used for a variety of properties, including residential homes, investment properties, and commercial real estate. However, it’s important to note that private lenders may have restrictions on certain property types or locations.

Just like with traditional mortgages, defaulting on your payments could result in foreclosure proceedings. However, private lenders may have more flexible options for borrowers who are struggling to make their payments. It’s important to discuss this with your lender before taking out a private mortgage.

Mortgage Squad has a network of trusted private lenders across Canada. Our experienced team will work with you to understand your needs and connect you with the right lender for your unique situation. We also offer personalized support throughout the application and approval process.