Highly Rated

Private Mortgage in Vaughan

Explore the best options for a private mortgage in Vaughan to secure your dream home today!

481+

200+

5000+

What is a Private Mortgage?

A private mortgage is a type of home loan that is obtained through an individual or a private lending company, instead of a traditional financial institution such as a bank or credit union. Private mortgages are typically used by individuals who may not qualify for a traditional mortgage due to factors such as bad credit or irregular income.

This option allows borrowers to secure the necessary funds for their home purchase, while also allowing investors to earn interest on their money.

Promotions

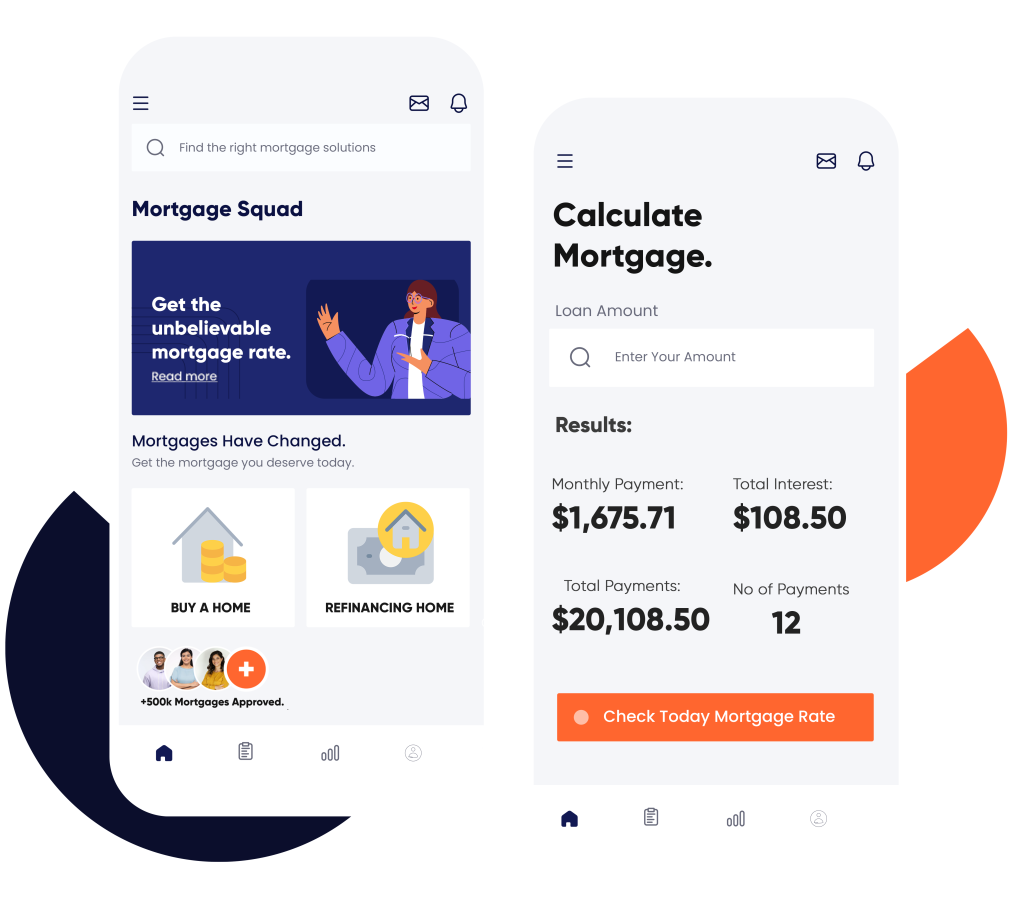

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Reasons For Getting a Private Mortgage in Vaughan

There are several reasons why individuals may choose to get a private mortgage in Vaughan. Individuals with bad credit, such as those with low scores or past bankruptcies, often face challenges securing traditional mortgages. However, private lenders usually have more lenient criteria and are willing to work with borrowers who have imperfect credit. Similarly, self-employed individuals, who struggle with traditional mortgage approvals due to irregular income, may find private lenders more accommodating as they assess the borrower’s overall financial situation.

Additionally, private mortgages offer the advantage of fast approval, often providing funding much quicker than traditional options, which can take weeks or months. They are also more flexible when it comes to financing unique properties, like fixer-uppers or rural homes, which might not qualify for traditional mortgages. Furthermore, private mortgages can be utilized for investment properties, such as rentals or house flipping projects.

Why Choose Mortgage Squad for Private Mortgage in Vaughan?

15+ Years of Experience

With over 15 years in the industry and more than 5,000 mortgages approved, we pride ourselves on being experts in providing private mortgages in Vaughan. Whether you’re a first-time homebuyer or looking to refinance, we are here to guide you through the process with personalized service and expertise.

Top-Rated Service

Our commitment to quality is reflected in our 5-star Google rating from over 200 reviews. We take immense pride in delivering exceptional service and always strive to exceed your expectations. Our team is dedicated to ensuring you receive the best experience possible, consistently working to improve and adapt to meet your needs.

Personalized Solutions

We offer personalized solutions for those requiring private mortgages in Vaughan. Whether you’re buying your first home, seeking a second mortgage to manage your finances, or looking for assistance with mortgage renewal and debt consolidation, our expert team is here to guide you.

Best Terms and Interest Rates

We leverage our strong relationships with our vast network of lenders to secure competitive rates that will make your wallet happy. Our team is committed to regularly negotiating better deals on your behalf, ensuring that any savings can be passed directly onto you. We aim to provide you with the best possible rates and terms to meet your financial needs.

Transparency and Fair Pricing

All costs are provided upfront with no hidden fees, allowing you to plan your budget confidently. We believe in transparency and integrity, offering honest and fair pricing to ensure your complete satisfaction. You can trust us to deliver value without any surprises, making your experience smooth and worry-free.

Speed and Efficiency

Our rapid mortgage approval process ensures you don’t miss investment opportunities, as we prioritize efficiency to keep your purchase on track. From application to approval, our team is dedicated to providing a smooth and swift experience, allowing you to focus on securing the best investment without unnecessary delays.

Calculate Your Costs Instantly

How Does Mortgage Squad Help in Mortgage Decisions?

At The Mortgage Squad, we understand that choosing the right mortgage can be overwhelming and confusing. Our team of mortgage experts has extensive knowledge and experience in the local market, allowing us to provide sound advice tailored to your specific needs. We take into account factors such as your financial situation, goals, and risk tolerance to offer personalized solutions that are best suited for you.

We conduct a comprehensive analysis of your financial situation to determine the most suitable options for a private mortgage in Vaughan for you. This includes evaluating your income, credit score, debt-to-income ratio, and other relevant factors. With our guidance, you can make an informed decision and choose a mortgage that aligns with your long-term financial goals. Check out our mortgage calculator and our pre-qualification services to get started.

Advantages of Collaborating with a Private Lender in Vaughan

Collaborating with a private lender in Vaughan offers several advantages. Private lenders offer several advantages compared to traditional banks, particularly in terms of flexibility and speed. Their more relaxed lending criteria make securing a mortgage easier for individuals with unique financial situations. Additionally, the approval process is typically faster, allowing borrowers to access funds sooner.

While lenders of private mortgage in Vaughan might charge slightly higher interest rates, they often provide competitive rates and terms that can complement an overall financial plan. Moreover, due to their smaller client base, private lenders are able to deliver personalized service and attention, ensuring a smoother and less stressful borrowing experience.

How to Find a Private Mortgage Lender in Vaughan?

Connecting with Mortgage Squad can be a pivotal step in finding the right private mortgage lender in Vaughan. Our team is dedicated to understanding the intricacies of the local real estate market, which allows us to guide you through the entire lending process with expertise and ease. We prioritize building lasting relationships with both our clients and a network of reputable private lenders, ensuring that you have access to a range of options tailored to your specific financial needs. By assessing your personal situation and goals, Mortgage Squad can match you with lenders who offer flexible terms and competitive rates, making the journey to securing a mortgage as seamless and efficient as possible.

When you choose to work with our mortgage agents, you benefit from a personalized approach that values your needs above all else. Our commitment extends beyond merely connecting you with lenders; we provide ongoing support and advice throughout the mortgage process. From the initial consultation to the final approval and beyond, our experts are available to address any questions or concerns you may have. Most importantly, our services are available across Ottawa, Mississauga, Toronto, Hamilton and beyond.

Our Agents

Mortgage Broker in Vaughan - Zubair Afzal

Zubair Afzal is the Principal Mortgage Broker in Vaughan & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Vaughan, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Get Approved

From Mortgage Broker in Vaughan Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Get in Touch With Us to Secure Your Private Mortgage Vaughan

Choosing us means choosing a mortgage broker Toronto that values your satisfaction and financial well-being. With promotions for cashback of up to $1,000 and a 100% customer satisfaction rate, we go beyond just securing a mortgage; we ensure you benefit from it. Whether you’re dealing with a straightforward scenario or a complex bad credit mortgage, our expertise in handling diverse mortgage situations makes us the ideal choice for your private mortgage needs in Vaughan.

Contact Mortgage Squad Inc. today and take the first step toward securing your private mortgage in Vaughan. Let us help you turn your property dreams into reality with service that exceeds your expectations every step of the way

FAQs

The interest rate on private mortgages in Ontario can vary depending on several factors, including the borrower’s credit profile, the lender, and the property type. Generally, private mortgage interest rates in Ontario range from 7.99% to 15.99%. These rates tend to be higher than those of traditional mortgages due to the increased risk taken on by the lender.

Yes, it is possible to obtain a private mortgage even if you have bad credit. Private lenders are more flexible than traditional banks and may be willing to overlook some credit issues. However, having a lower credit score may result in higher interest rates or stricter terms. At Mortgage Squad, we work with various private lenders who specialize in working with individuals with less-than-ideal credit scores. We will work with you to find the best options available to meet your needs and financial goals.

In most cases, yes, you will need to have a down payment for a private mortgage. However, the amount required may vary depending on the lender and your financial situation. Some lenders may require a larger down payment if you have a lower credit score, while others may be more flexible. It is essential to discuss your down payment options with your Mortgage Squad advisor to determine the best course of action for your specific circumstances.

If you are struggling to secure financing through traditional lenders, a private mortgage may be a viable option for you. Private mortgages can benefit individuals who have a lower credit score, need quick approval, or require temporary financing. However, it’s essential to carefully evaluate your financial situation and discuss your options with a Mortgage Squad advisor before committing to a private mortgage. We can help you assess the pros and cons and determine if a private mortgage is the right choice for you.

The application process for a private mortgage may vary depending on the lender and your specific situation. Generally, you will need to complete an application form and provide essential documents such as proof of income, identification, and property details. Private lenders may also conduct a credit check and property appraisal before approving your mortgage.

As mentioned previously, you will typically need to provide proof of income, identification, and property details when applying for a private mortgage. Other required documents may include bank statements, tax returns, and employment verification. Your Mortgage Squad advisor can help you prepare all the necessary documentation for your application.