- 201 Millway Ave #17, Concord

- support@mortgagesquad.ca

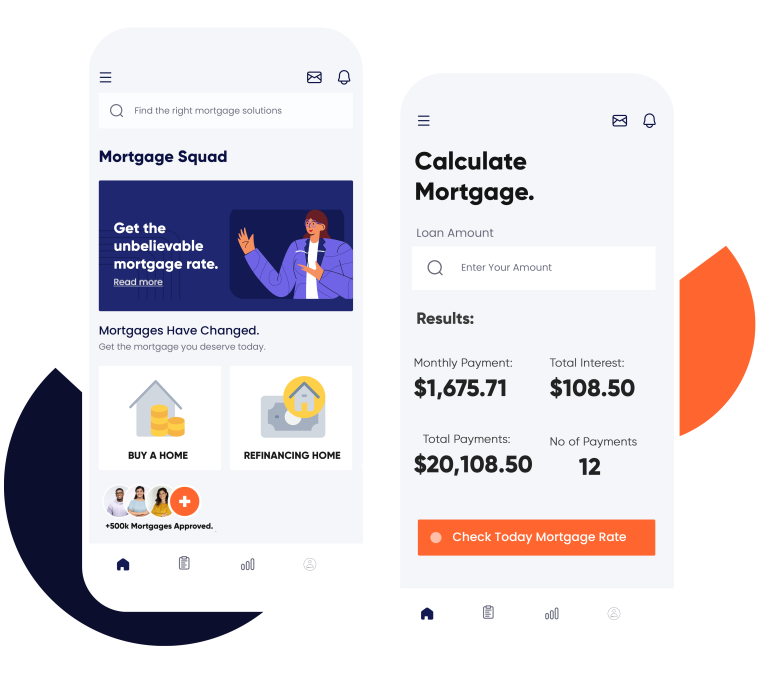

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

Free Legal Fee Program - A $1000 Value