The Canadian Mortgage and Housing Corporation (CMHC), is a government-owned entity, that was established in 1946, to help returning veterans access housing. Several decades later it has become the gateway for all Canadians to able to access the housing market. The policies and guidelines set in place by it are designed to protect consumers and ensure that they are able to meet their commitments.

Furthermore, the CMHC has set out useful tools buyers or potential buyers can use to determine what their mortgage payments will be and whether or not they can afford them. These calculators can be a bit confusing at first, but we will break them down simply for you so that these tools are accessible to everyone.

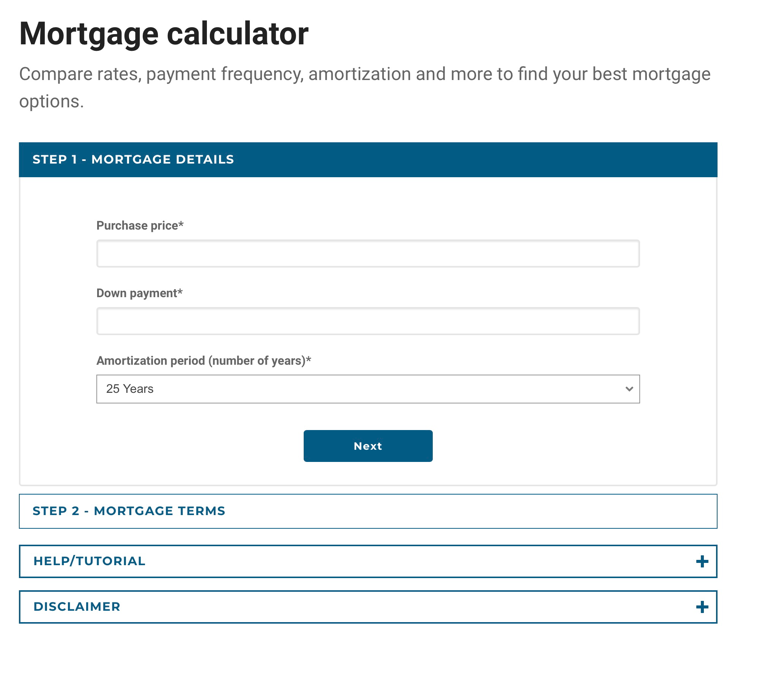

First, visit https://www.cmhc-schl.gc.ca/en/consumers/home-buying/calculators/mortgage-calculator

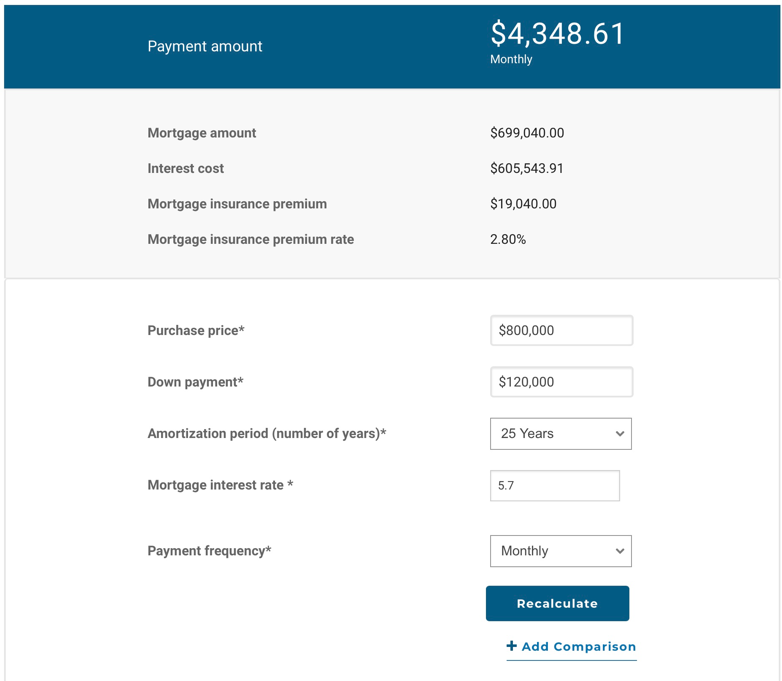

Where you will be greeted by this interface:

To move forward with your calculation enter the purchase price of the home, then what you plan to put in for a down payment.

Now, a quick note before we go any further, If your down payment is under 20% of the purchase price, you will need mortgage insurance on your loan. We will determine the size of this premium and automatically include it in the calculations. Mortgage insurance is only available when the purchase price is below $1,000,000.

Afterward, select your amortization period. This is the amount of time you will have to pay your loan in full. If you are not sure, contact your, financial advisor, as to what the best option is for you. The typical amortization period in Canada is 25 years. Therefore, for this example, we will use 25 years.

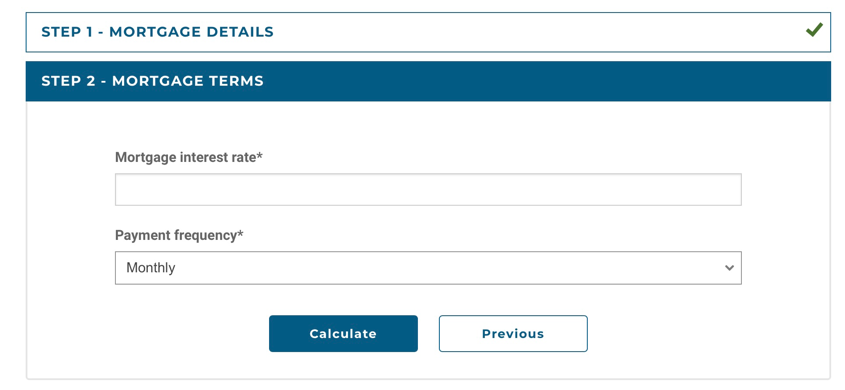

After entering your pertinent information, you should click on the ‘Next’ button and this interface will open:

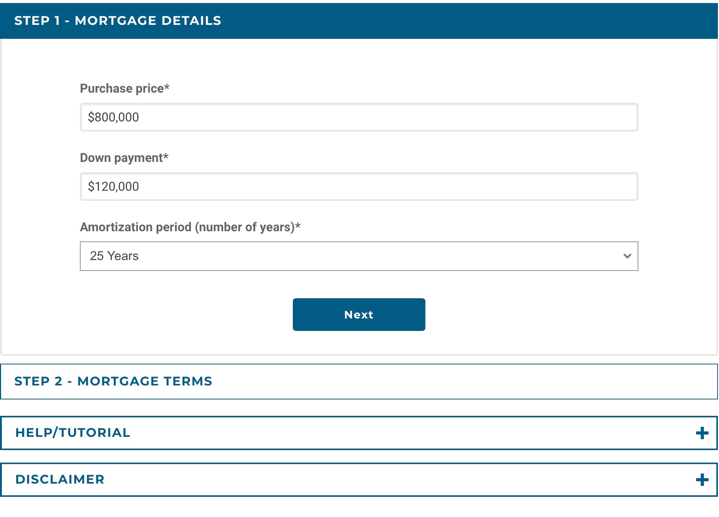

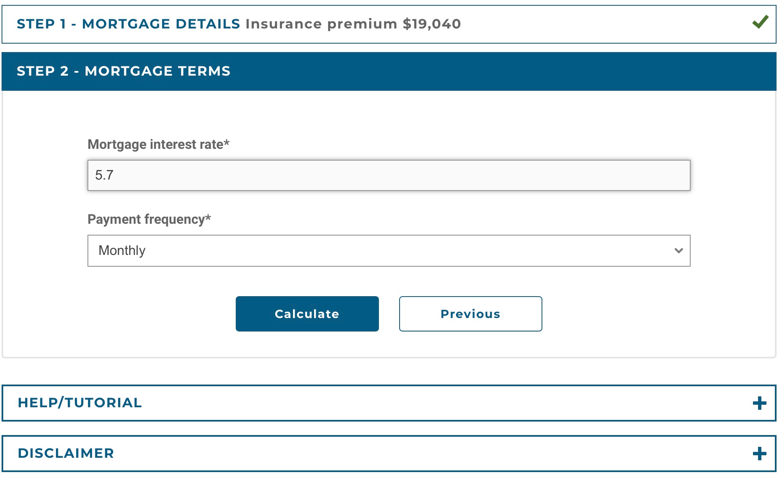

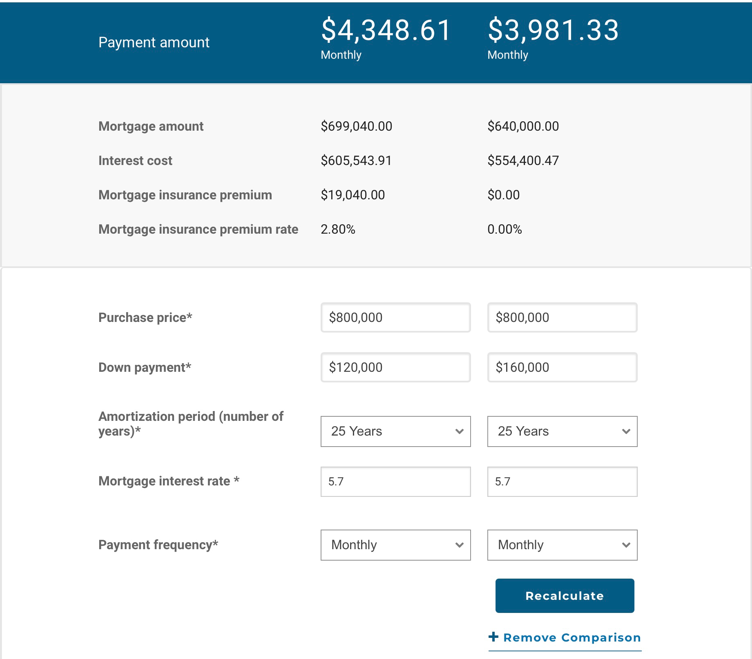

We have two example for you, both with the same purchase price, $800,000, and the same interest rate, 5.7%, and the same payment frequency, the only difference being the amount in down payment. Observe how the calculator adds the CMHC mortgage loan insurance to monthly payments so you do not have to. We will now use the comparison tool to see how much the monthly payments would differ if the down payment was 20%.

Now, that you have looked at mortgage options, it would be wise to go over your debt service ratios, thankfully, all of these tools are available to you on the CMHC website.

.