Highly Rated

Mortgage Broker in Niagara Falls

Our experienced mortgage brokers in Niagara Falls are here to understand and meet your specific needs. Explore your options today.

481+

200+

5000+

Our Services as a Mortgage Broker in Niagara Falls

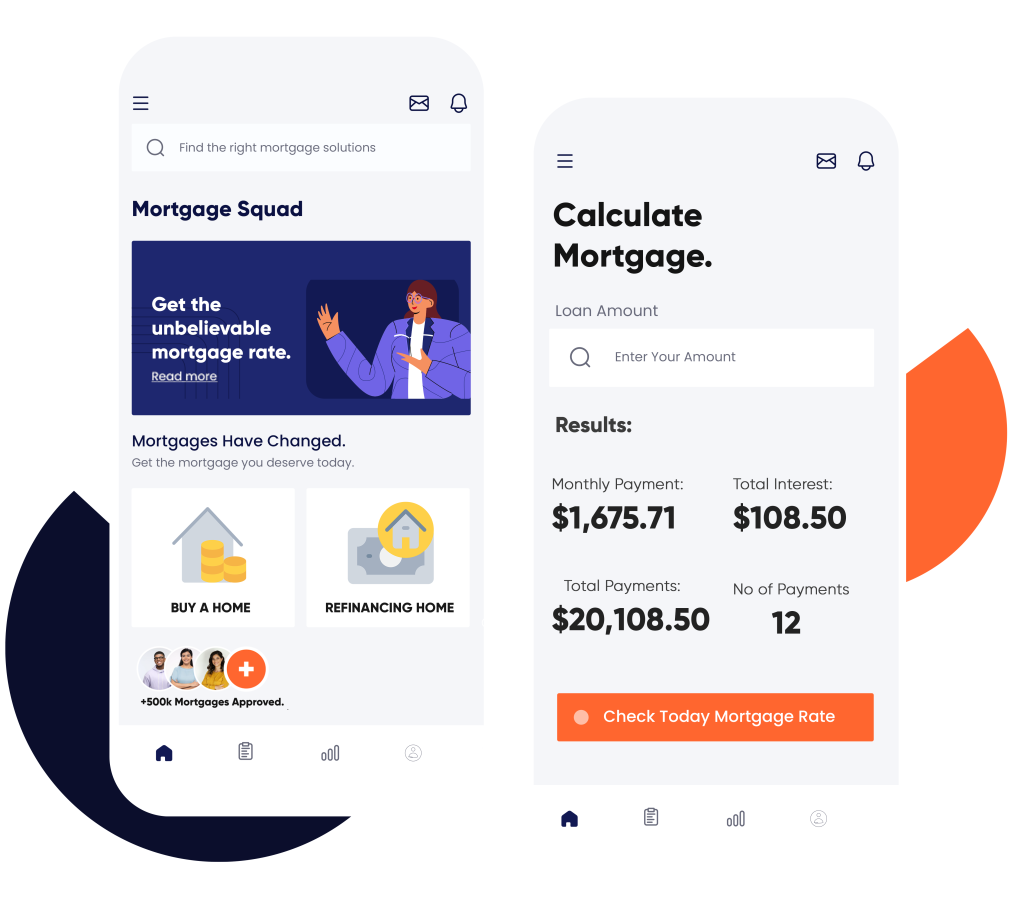

At Mortgage Squad, we take pride in offering a wide range of mortgage services tailored to meet your unique needs. Whether you’re a first-time homebuyer looking to purchase your dream home, seeking a second home mortgage, or in need of a private mortgage, our dedicated team is here to provide the right solutions. We also specialize in assisting self-employed individuals and those with bad credit, offering options that include debt consolidation, mortgage refinance, and renewal.

Our experienced experts are committed to guiding you through every step of the mortgage process, ensuring that you feel informed and confident in your decisions. We understand that navigating mortgages can be complex, and our goal is to simplify that journey for you.

Additionally, we offer mortgage solutions for vacation homes and more. Our services are available in Newmarket, St. Catharines, North Bay, Peterborough, Brantford and nearby cities. Explore your options with Mortgage Squad — your trusted mortgage broker!

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Simplified Paperwork to Help You Focus on What Truly Matters

Who wants to drown in a sea of paperwork? Definitely not you! That’s exactly why Mortgage Squad is here. As your mortgage broker in Niagara Falls, we take the stress out of securing a mortgage by simplifying what can often feel like a daunting process. Our passionate team has fine-tuned every aspect of the paperwork, so you can spend less time sorting through documents and more time dreaming about your future home’s style and charm.

We know that legal terms and endless forms can be confusing, so we focus on making your experience smooth and straightforward. Our team is here to equip you with the knowledge and confidence to navigate the mortgage landscape. Let us tackle the nitty-gritty details while you concentrate on what truly matters: crafting a cozy haven for you and your family. Your dream home is just around the corner, and we’re excited to guide you through every step of this journey!

Calculate Your Costs Instantly

More than 15 Years of Experience and a Rich Depth of Knowledge

With over 15 years of experience as a mortgage broker in Niagara Falls, we’ve seen it all and learned valuable lessons along the way. Our intimate knowledge of the local market empowers us to tackle any challenges that arise during the mortgage journey. We take pride in our ability to adapt and cater to the unique needs of each client, ensuring you receive tailored and insightful guidance every step of the way.

Our expertise opens the door to a variety of mortgage solutions designed just for you. Whether you’re a first-time homebuyer or considering refinancing, our goal is to find the perfect options that fit your financial aspirations. You can relax knowing you’re in good hands with our dedicated team. Plus, we can help you secure a private mortgage in Niagara Falls, giving you even more flexibility and opportunities in your home financing adventure. Let’s make your dream home a reality!

Get Approved

From Mortgage Broker in Niagara Falls Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

We Also Offer Pre-Qualification Services

Discovering your dream home should be exciting, not frustrating — especially when it comes to mortgage approval. That’s where our thorough pre-qualification services come in. By getting pre-qualified, you’ll have a solid grasp of your budget, which helps prevent the letdown of losing out on great properties. Armed with your pre-qualification, you’ll feel empowered and ready to seize the moment when the ideal home comes along.

Optimal Terms to Safeguard Your Interest

Navigating the mortgage landscape involves more than just getting a loan; it’s about customizing the best terms for your individual financial needs. As the top mortgage broker in Niagara Falls, we understand that everyone’s situation is unique, and our mission is to help you find the most advantageous terms that align with your goals. Whether you’re after a competitive interest rate, flexible repayment plans, or enhanced loan features, we’re here to make sure you secure an outstanding deal that works for you.

Why Choose Us As Your Mortgage Broker in Niagara Falls?

Here are some reasons to choose Mortgage Squad as your go-to mortgage partner:

- Customer-First Mindset: Your satisfaction is our mission. We put your needs at the forefront of everything we do.

- Clear and Honest Practices: Experience transparent services with no hidden fees or unexpected surprises.

- Local Expertise: As a proud member of the Niagara Falls community, we truly understand the area and are dedicated to helping our neighbors realize their dreams of homeownership.

Choosing the right mortgage broker can significantly shape your home-buying experience, and Mortgage Squad is here to make it a breeze. We provide a seamless process, deep industry knowledge, pre-approval benefits, and competitive terms to offer you the best mortgage options available. Let us help you unlock the door to your new home!

Our Agents

Mortgage Broker in Niagara Falls - Zubair Afzal

Zubair Afzal is the Principal Mortgage Broker in Niagara Falls & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Niagara Falls, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Reach Out to Us!

Have questions? Don’t hesitate to contact us! We’re here to support you every step of the way and can’t wait to help you embark on your journey to homeownership. Welcome to your new adventure!

FAQs

Absolutely! Partnering with a mortgage broker opens the door to a diverse array of lenders and loan options, which can lead to more favorable terms and rates for your mortgage.

While having good credit certainly simplifies the mortgage process and can help you secure better rates, there are also options for those with lower credit scores. At Mortgage Squad, we’re dedicated to helping you explore the best solutions tailored to your situation.

Choosing a local mortgage broker means working with someone who has a deep understanding of the housing market and lending climate in your area. They often have valuable connections with local lenders that could work to your benefit.

Before your conversation with a mortgage broker, it’s beneficial to have a clear picture of your financial status, including income, expenses, and credit score. Also, think about the type of home you want to buy and how much you can afford for a down payment.

Yes, you can still find a good interest rate even if you don’t fit traditional bank criteria. At Mortgage Squad, we specialize in alternative lending solutions for those who may not qualify for standard mortgages. We collaborate with a network of lenders who offer competitive rates and terms for non-traditional borrowers.

Definitely! Securing a mortgage as a self-employed person is possible, though the process may differ slightly and require extra documentation to prove your income. The Mortgage Squad team has extensive experience helping self-employed clients find the right financing options to meet their needs.