Highly Rated

Mortgage Broker in Thunder Bay

Our experienced mortgage brokers in Thunder Bay are here to understand and meet your specific needs. Explore your options today.

481+

200+

5000+

Mortgage Broker in Thunder Bay Offering a Variety of Products

At our brokerage, we specialize in providing a comprehensive range of mortgage options tailored to fit every unique situation. Whether you’re looking to secure a first or second home mortgage, we have the expertise to guide you through the process with ease. We also cater to specialized needs such as private mortgages, perfect for those who require more flexibility than traditional lenders offer.

For the self-employed individuals seeking a home financing solution or those facing challenges due to bad credit, we’re committed to finding a path that works for you. Moreover, we can help you navigate debt consolidation to simplify your financial obligations, as well as assist with mortgage refinance and renewal to ensure you’re always getting competitive rates.

Our services extend beyond being a mortgage broker for Thunder Bay residents, reaching out to clients in Barrie, Newmarket, St. Catharines, North Bay, and London, as well as nearby cities. We are committed to providing personalized service no matter where you are. Whether you’re interested in investing in a vacation home or looking for advice to maximize your current assets, our team is here to provide guidance and support every step of the way. Let us help you make informed decisions and achieve your mortgage goals effortlessly, ensuring peace of mind and financial stability.

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

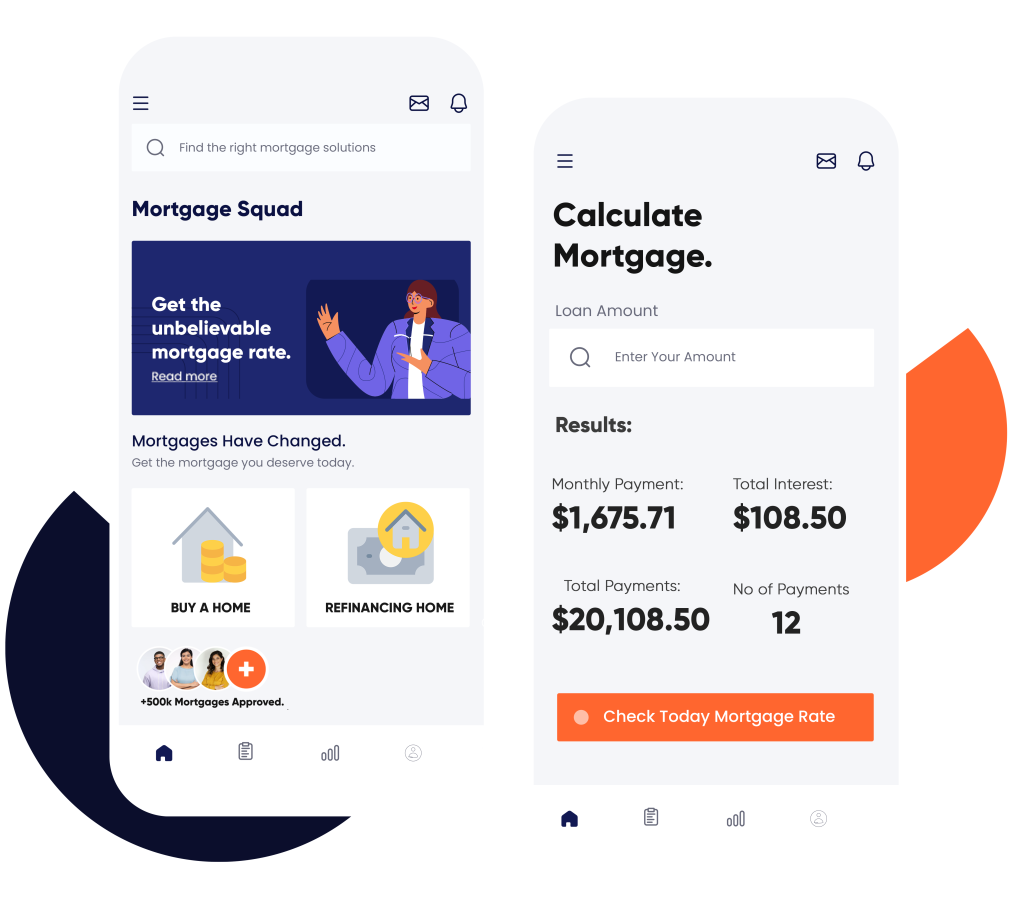

Unlock Your Dream Home with Our Mortgage Calculator and Pre-Qualification Services

One of the most daunting aspects of purchasing a home is understanding your budget and what you can afford. That’s where our mortgage calculator comes in handy. By simply inputting some basic information, it will provide you with an estimated monthly payment and help you determine which mortgage option works best for you. Furthermore, our pre-qualification services take the guesswork out of house hunting by providing you with a clear picture of your financial standing and how much mortgage you qualify for.

Find out how you can improve your credit score for better eligibility.

Calculate Your Costs Instantly

Expert Advice and Ongoing Support from Start to Finish

As a leading mortgage broker in Thunder Bay, we believe that getting a home loan should be simple and stress-free. That’s why we provide expert advice and ongoing support throughout the entire process, from application to closing. Our experienced and knowledgeable team will walk you through every step, ensuring that you fully understand all the details and feel confident in your decisions. Trust us to make your journey a smooth one.

Refinance or Renew with Ease

As life changes, so do our financial needs. That’s why we offer services for both mortgage refinancing and renewal. Whether you’re looking to consolidate debt, lower your interest rate, or access equity for renovations or investments, we can help you navigate the process and secure the best possible terms for your unique situation. And when it comes time to renew your homeowner’s loan, our mortgage broker in Thunder Bay work with you to find the best options available and ensure that you continue receiving competitive rates and terms.

Additional Services for a Comprehensive Experience

Why Choose Us As Your Mortgage Broker In Thunder Bay?

- Personalized Service: We understand that everyone’s financial situation is unique, which is why we tailor our services to meet your specific needs. Our team takes the time to get to know you and your goals, crafting personalized solutions that align with your aspirations and financial capabilities.

- 15+ Years of Experience: With over 15 years in the brokerage industry, we bring a wealth of knowledge and expertise to every client interaction. Our seasoned professionals have encountered a wide variety of scenarios, providing them with the skills to handle even the most complex cases with ease and efficiency.

- 5,000+ Approved Mortgages: Having successfully facilitated over 5,000 approved mortgages, our track record speaks for itself. This extensive experience highlights our commitment to securing the best home financing solutions and demonstrates our ability to consistently deliver satisfying outcomes for our clients.

- Wide Network of Lenders Across Canada: We are proud to maintain a wide-reaching network of lenders across Canada, providing our clients with access to some of the most competitive rates and terms in the market. Our connections span numerous financial institutions, allowing us to find the perfect fit for your financing needs, no matter your location.

If you are looking for a trustworthy and experienced mortgage broker in Thunder Bay, look no further than Mortgage Squad. Our personalized service, extensive experience, and broad network of lenders make us the top choice for Canadians seeking solutions.

Get Approved

From Mortgage Broker in Thunder Bay Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Our Agents

Mortgage Broker in Thunder Bay - Zubair Afzal

Zubair Afzal is the Principal Mortgage Broker in Thunder Bay & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Thunder Bay, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Get in Touch

Contact us today to start your journey towards owning your dream home or achieving your financial goals through mortgage financing. Our team is dedicated to helping you every step of the way, providing guidance and support as you navigate the often complex world of home loans. Let us ease your burden and find the best solution for you – contact Mortgage Squad now!

FAQs

Key factors include your credit score, income, employment history, debt-to-income ratio, and the amount of your down payment. Lenders evaluate these factors to assess your ability to repay the loan.

A fixed-rate mortgage has an interest rate that remains constant throughout the loan term, providing predictable monthly payments. This stability makes it popular among borrowers seeking consistent budgeting.

While the traditional down payment is 20% of the home’s purchase price, some lenders offer lower down payment options, especially for first-time buyers. However, the more you can put down, the less you’ll need to finance.