Highly Rated

PRIVATE MORTGAGE IN BRAMPTON

Get started today and discover how we can help you secure private mortgage in Brampton!

481+

200+

5000+

What's a Private Mortgage?

A private mortgage is a home loan provided by an individual or a private lending company, rather than a conventional bank or credit union. It’s often chosen by those who don’t meet the criteria for traditional mortgages because of issues like bad credit or being self-employed. This alternative gives borrowers access to funds for buying a home and allows lenders to earn interest on their investments.

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Why Consider a Private Mortgage in Brampton?

Opting for a private mortgage in Brampton can be beneficial for several reasons. Individuals with bad credit, including low scores or previous bankruptcies, often find it challenging to secure traditional mortgages. In contrast, private lenders tend to have more flexible requirements and are open to working with those who have less-than-perfect credit.

Moreover, self-employed individuals often face difficulties with conventional mortgage approvals due to fluctuating income. Private lenders, however, typically evaluate the overall financial picture, making them more accommodating.

Another advantage of applying for private home financing is their quick approval process, providing faster funding compared to traditional methods that may take weeks or even months. They also offer more flexibility in financing unique properties, such as fixer-uppers or rural homes, which might not meet the criteria for traditional mortgages. Additionally, private mortgages can be an excellent option for investment properties, including rental units.

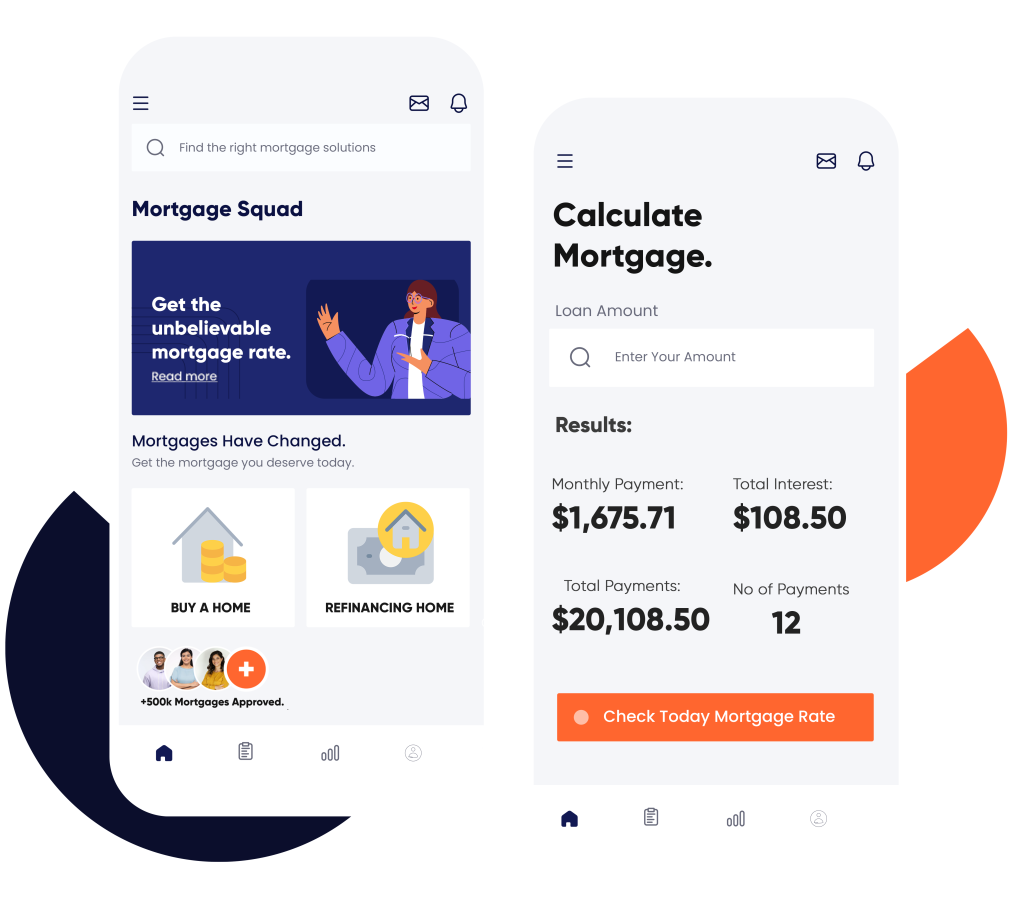

Calculate Your Costs Instantly

Why Clients Choose Us for Private Mortgage in Brampton

Extensive Experience

With more than 15 years in the mortgage industry and over 5,000 approved loans, we are seasoned experts in securing private mortgages in Brampton. Whether you’re buying your first home, refinancing, or need help with renewal, we offer personalized guidance.

Exceptional Service

Boasting a 5-star rating on Google from over 200 reviews, our commitment to quality service is unmatched. We consistently strive to exceed expectations, ensuring that your experience is not only positive but memorable. Our team is devoted to adapting and improving to meet your needs.

Tailored Solutions

We provide customized solutions for individuals in need of private mortgage in Brampton. Whether you’re purchasing a vacation home, require a second mortgage, or need help with a home equity line of credit or debt consolidation, our expert team is ready to assist you.

Competitive Rates and Terms

By leveraging our strong relationships with a wide network of lenders, we secure competitive rates that benefit your finances. Our team is committed to finding better deals, passing the savings directly to you, and offering the best rates and terms tailored to your financial goals.

Honest and Fair Pricing

We offer transparent pricing with upfront costs, ensuring no hidden fees and allowing you to confidently plan your budget. Our commitment to transparency and integrity ensures your satisfaction without surprises, making the process smooth and worry-free.

Fast and Efficient Process

Our quick approval process means you won’t miss out on investment opportunities. Prioritizing efficiency, we ensure your mortgage approval is handled swiftly, so you can focus on your investment without unnecessary delays.

What Can Mortgage Squad Do for Your Mortgage Decisions?

Choosing the right mortgage can feel overwhelming, but at The Mortgage Squad, we’re here to simplify the process. Our team of seasoned mortgage professionals leverages their extensive knowledge of the local market to offer advice tailored to your unique needs. We consider your financial situation, objectives, and risk tolerance to provide personalized mortgage solutions.

We perform a detailed assessment of your financial status, evaluating factors like income, credit score, and debt-to-income ratio to identify the best private mortgage options in Brampton for you. With our expert insights, you can confidently select a mortgage that supports your long-term financial aspirations. Explore our mortgage calculator and pre-qualification services to get started with your application. Our service are also available across Toronto, Barrie, Hamilton, Mississauga, Ottawa, and beyond.

Get Approved

From Mortgage Broker in Vaughan Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Why Apply for Private Mortgage in Brampton?

Brampton is a thriving city with a diverse population and a strong economy. Its close proximity to Toronto makes it an attractive location for real estate investment, with various housing options available at competitive prices. Private mortgage in Brampton offers flexible terms and rates, making them ideal for investors looking for customized mortgage solutions.

Moreover, private lenders are not as strict with their approval criteria as traditional banks, allowing individuals with lower credit scores or unconventional sources of income to secure financing. As such, private home loans can be an excellent choice for self-employed individuals or those who may have faced financial setbacks in the past.

How to Find Private Lenders in Brampton?

Finding a private mortgage lender in Brampton is easier with the help of Mortgage Squad. Our team specializes in the local real estate market, offering guidance and expertise to simplify the lending process. We focus on building strong relationships with clients and trusted private lenders to provide you with a variety of tailored financial options. By evaluating your unique circumstances and objectives, we connect you with lenders who offer flexible and competitive mortgage terms, ensuring a smooth and efficient process.

Choosing us as your mortgage broker means you receive a personalized service that prioritizes your needs. We go beyond simply introducing you to lenders; we offer continuous support and advice throughout the mortgage journey. From the first consultation to the final approval, our experts are here to answer your questions and address your concerns. This commitment to service ensures you receive financial solutions that match your goals and equips you with the knowledge to make informed decisions on your path to homeownership.

Our Agents

Mortgage Broker in Brampton - Zubair Afzal

Zubair Afzal is the Principal Mortgage Broker in Brampton & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Brampton, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Get Started with Brampton's Private Lending Experts

Still uncertain about private lending? We understand – the process can feel overwhelming without the right support. However, with our team by your side, you’ll always feel empowered and in control.

We’re here to guide you through every step, from clarifying your options to negotiating fiercely on your behalf. You can trust that we prioritize your best interests at all times.

Don’t let funding obstacles hinder your real estate aspirations. Reach out to us today to get pre-approved with the leading mortgage lenders in Brampton. With our exclusive rates and VIP service, you won’t find a better private lending solution anywhere else!

FAQs

Yes, it is possible to obtain a private mortgage with poor credit. Private lenders tend to be more flexible and understanding when it comes to credit scores, as they prioritize the property’s value and the borrower’s ability to repay the loan. However, having a higher credit score can help you secure more competitive interest rates.

Yes, private mortgages can be used for investment properties. Private lenders often have fewer restrictions and requirements compared to traditional lenders, making them a more viable option for individuals looking to invest in real estate.

Private mortgage interest rates in Ontario fluctuate based on factors like the borrower’s creditworthiness, the lender’s policies, and the type of property involved. Typically, these rates range from 7.99% to 15.99%, which are generally higher than traditional mortgage rates because of the greater risk lenders assume.

Yes, you can pay off your private mortgage early. However, some private lenders may charge prepayment penalties if the loan is paid off before a certain period of time. It’s important to carefully review the terms and conditions of your mortgage agreement before committing to it.

In the event that you are unable to make your private mortgage payments, the lender has the right to take legal action against you and potentially foreclose on the property. It’s important to communicate with your lender and try to work out a solution before defaulting on your payments.

Yes, you can refinance your private mortgage. This involves taking out a new loan with better terms or interest rates to pay off the existing one. However, it’s important to consider the costs associated with refinancing and whether it will ultimately save you money in the long run.