- 201 Millway Ave #17, Concord

- support@mortgagesquad.ca

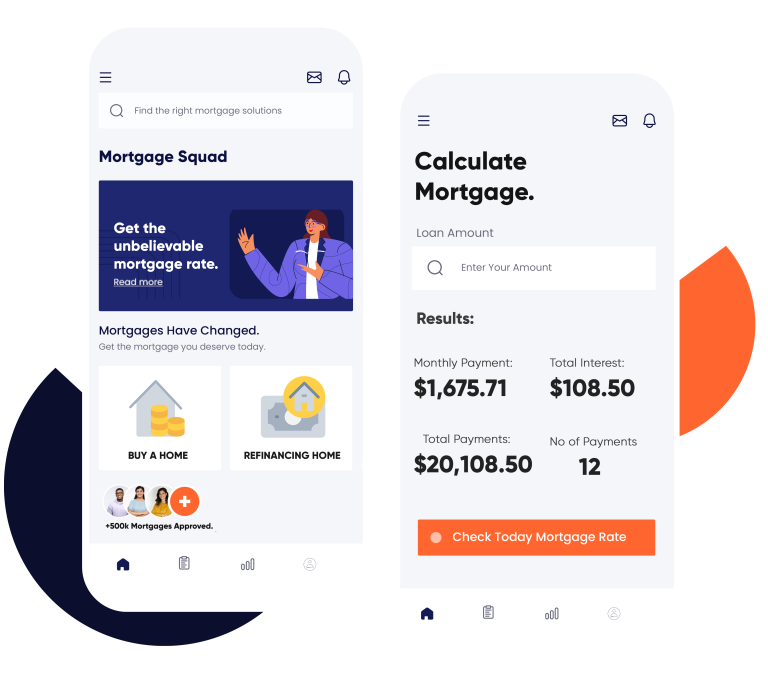

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

Free Legal Fee Program - A $1000 Value

Here’s how you can build credit as a self-employed individual in Canada.

These can vary, it is best to reach us to know exactly what you will need but in many cases some of the essential documents you will need include: