- 201 Millway Ave #17, Concord

- support@mortgagesquad.ca

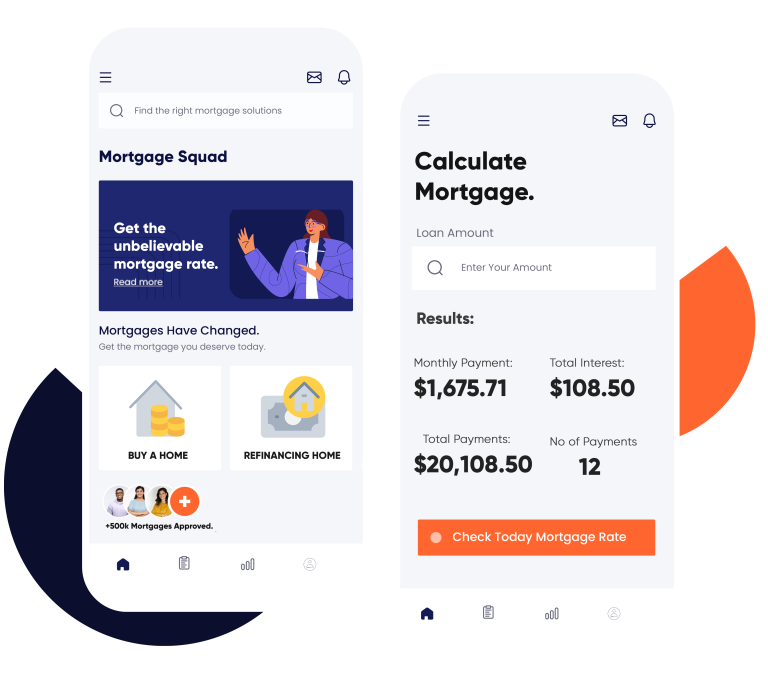

Our pre-qualification services help you analyse your financial condition. Get an idea of whether you are eligible for a mortgage service.

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

Free Legal Fee Program - A $1000 Value

In Canada, where a suitable mortgage agreement is challenging, our expert team guides you to make the best deal within your budget. No hidden charges, no stress