Considerate how much the payments of mortgage will be is an essential part of attaining a mortgage that you can easily afford to service long term. A mortgage payment calculator can help you better recognize your estimated payment amount for borrowing to buy a home.

For exact amount details, this tool can test different kinds of payment scenarios dependent on your payment frequency, amortization period, or mortgage amount. When you know about the estimated mortgage payment, you will better compare all home-buying options.

It is necessary for you if you are a first-time customer, you are finding to remortgage, buy or move to an additional home, or you are a buy-to-let landlord. Mortgage calculators can help you in useful ways to find out about your monthly repayments, how much mortgage you can borrow, and more.

Why Use A Mortgage Payment Calculator?

When you decide to buy a home, it is easy to emphasize the headline figures, like the final buying price or overall mortgage amount. But in some ways, the most related number of your mortgage will be your daily repayments.

After all, your mortgage payments are the amount that you will need to take from your paycheque every month to keep all your mortgage amount under control.

Using a mortgage payment calculator allows you to know how much you will pay every month for any mortgage size, at any rate. It means you can match homes & mortgage products with self-confidence, all the while knowing accurately how much you will be on the hook for in every scenario.

How to calculate mortgage payments?

Calculating mortgage payments manually is more complicated, but mortgage payment calculators make it easier. It gives you all things you require to test different scenarios and help you to decide what mortgage is best for you.

Many factors estimate your regular mortgage payments. Here mentioned factors are most important:

- Total Mortgage Amount: It’s your new home price, down payment, and over mortgage insurance, if appropriate.

- Amortization period: It’s your total mortgage life, and the year’s number of your mortgage payments will determine extent across.

- Mortgage rate: It is the interest rate that you will pay on your mortgage.

How A Mortgage Calculator Helps You?

Your monthly home payment is vital for assuming how much house you can easily afford. Use a mortgage calculator provides the exact estimated amount. To run scenarios, you can easily change the loan details in the calculator. As a result, you can decide:

- Which type of home loan term length is right for you? A mortgage of 30-year fixed-rate can lower your monthly payment. But you will pay more interest on the loan. A mortgage of the 15-year fixed rate will decrease your total interest payments, but the monthly payment will be higher.

- An Adjustable-rate mortgage is a good option. It will start with a teaser interest rate, then the rate of loan changes lower or higher over time. A 5/1 adjustable-rate mortgage will be a better choice if you plan a new home just for some years. You will be aware of monthly mortgage payments that can change when the starting rate expires, particularly if interest rates are trending higher.

- If you want to buy too many homes. It can give you an actual check on how much you will pay every month, particularly when considering all the costs, containing insurance, taxes, & private mortgage insurance.

- If you are putting sufficient money down. With a minimum down payment usually as low as 3%, it is easier than constantly to put only a little money down. The mortgage payment calculator will help you decide what the best down payment is for you.

Understanding Your Mortgage Payment

Your mortgage payment major part is the principal & the interest. The principal is your borrowed amount, while the interest is your sum to pay your lender. Your lender may collect the extra amount each month to put into escrow, pay directly to the tax collector of local property & insurance carrier.

A Mortgage Payment Included Typical Costs

- Principal: Amount you will borrow from the lender.

- Interest: The lender charges to lend you the money. It is also known as the annual percentage.

- Property Taxes: Local authorities measure an annual tax on your property. If you have an escrow account, you will have to pay about one-twelfth of the annual tax bill with the monthly mortgage payment.

- Homeowners Insurance: The policy of your insurance can cover financial losses from storms, theft, fire, tree falling, & other hazards. If you live in a flood zone, you will have a different policy, and if you live in an earthquake country, you may have a third policy for insurance. With property taxes, you will have to pay one-twelfth of the annual insurance premium every month, and your servicer or lender pays the premium when it is due.

- Mortgage Insurance: If your down payment is less than 20% of your home buying price, you will most likely be on the hook for your mortgage insurance that will also add to the monthly payment.

How to Use the Mortgage Payment Calculator?

First, enter the buying price after choosing an amortization period & mortgage rate to use the calculator. The calculator will display the available best rates in your province, but you will also add a change rate. The calculator will display your mortgage payments.

The mortgage payment calculator, by default, will show you four different monthly payments that depend on your down payment size. Automatically, it’ll calculate the CMHC insurance cost. You can also change your down payment size & the payment frequency to know how the regular payment will be affected.

The calculator also shows how much cash you will require for closing costs. You can estimate your total expenses every month and know about your payments if mortgage rates go high.

If you are buying a home, it is best to use a calculator. If you are refinancing or renewing and know the total mortgage amount, use the “Renewal or Refinance” tab to mortgage payments estimation without down payment accounting.

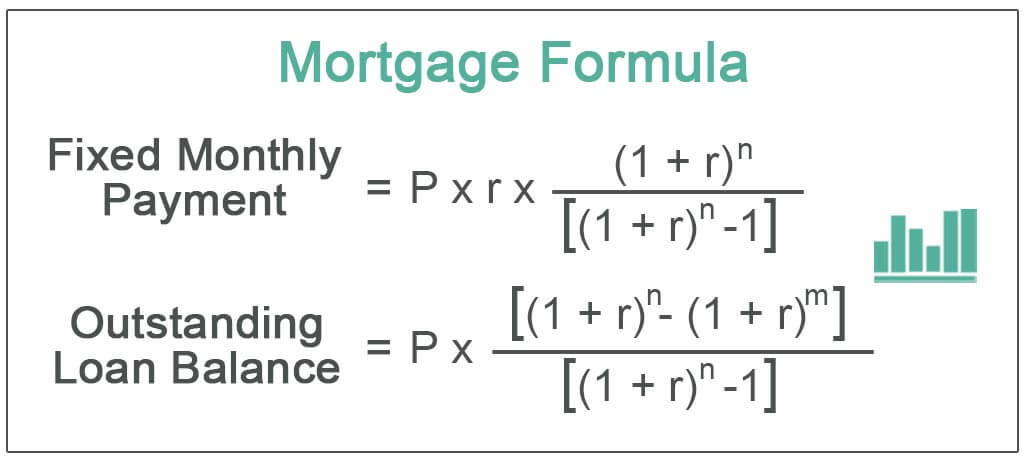

Calculating Formula of Mortgage Payment

Want to figure out monthly mortgage payment, here is an equation to help you to calculate Mortgage payment manually:

M = P [ i ( 1 + i ) ^ n ] / [ (1 + i ) ^n – 1 ]

Variables Abbreviations are:

- M = Monthly Mortgage Payment

- P = Principal amount

- i = Interest rate. If your lender lists annual figure interest rates, so you will divide by 12, for every month.

- n = Number of payments over the loan life. If you take a 30-year fixed-rate mortgage, it means n = 30 years x 12 months per year or 360 payments.

Reducing Monthly Mortgage Payments

There are several ways to lower the monthly mortgage payments. You can decrease the buy price, extend the amortization period, make a bigger down payment, or search for a lower mortgage rate. Use the calculator to understand your payment in different scenarios.

Remember, if the down payment is less than 20%, your amortization period is 25 years. It is good to speak with your mortgage broker to get lower mortgage rates. The mortgage calculator allows you to test the scenarios to reduce your monthly payments:

- Extend the term (Number of years to pay off the loan)

- Buy less house.

- Avoid paying PMI (Private Mortgage Insurance)

- Get a lower interest rate.

How to Pay Off Your Mortgage Faster?

Paying off the mortgage may look like a distant dream at first. It is good news that even small sums of amount can help you reach the goal sooner. Here are two main ways to pay the mortgage down faster & save on interest costs.

- Take Lump-Sum Payments Advantage

Making lump-sum payments will help decrease the principal balance, decreasing the pay-off time on your mortgage loan, which lets you save on interest.

- Take Increased Payment Advantage

Take the increased Payment options or select a shorter amortization period. It will increase the monthly payments but decrease the interest amount you pay over your mortgage shortened life. It depends on the mortgage type.

What Is An Amortization Schedule?

An amortization schedule displays your monthly payments over time and indicates the portion to paying down the principal vs. interest. The maximum amortization period on less than 20% down payments is 25 years, and the maximum is 35 years.

Your term will be short though 25 years amortization period. With the most common term of 5 years, amortization will be up for regeneration before the mortgage is paid off. Therefore amortization schedule shows your mortgage balance at your term-end.

Monthly Mortgage Payments Can Go Up:

Keep in mind that your monthly payment can go up any time if:

- Homeowners’ insurance premiums or property taxes rise. In most payments, these costs will include.

- You gain a late payment fee from the servicer of the mortgage loan.

- If an adjustable-rate mortgage you have, the rate will rise during the adjustment period.

Summary

Mortgages are the biggest commitments that you will make in your financial life. And with different options, it can be hard to know what they will cost you. But Mortgage Payment Calculator makes it easier.

You can adjust your mortgage term, deposit & interest rate to get the best idea to manage your monthly payments. You will need your property price or the amount left on your mortgage to get started.