Highly Rated

Mortgage Broker in Hamilton

Our experienced mortgage brokers in Hamilton are here to understand and meet your specific needs. Explore your options today.

481+

200+

5000+

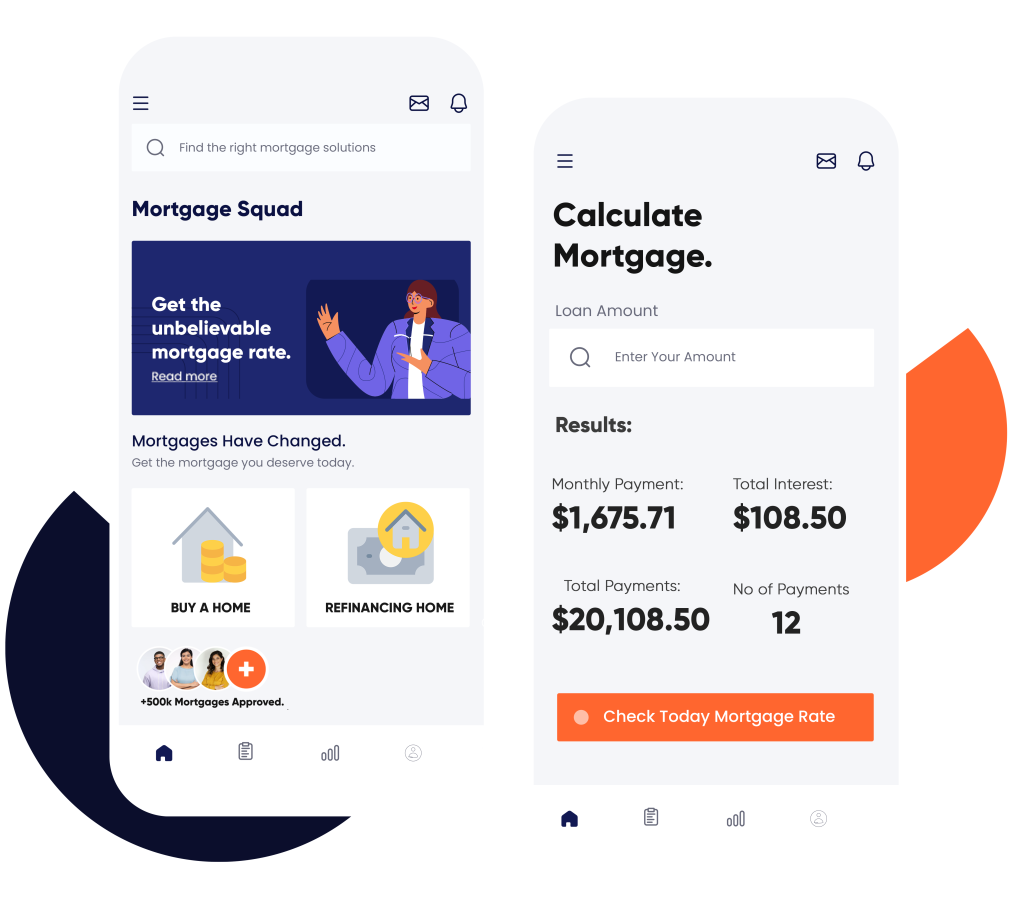

A Mortgage Broker in Hamilton Offering Diverse Products

Mortgages are an essential part of the home-buying process. They allow individuals and families to purchase homes without having to pay the full amount upfront. However, navigating the mortgage market can be a daunting task, especially for first-time buyers. That’s where we come in. At Mortgage Squad, we are dedicated to helping you find the best mortgage options that suit your specific needs.

Whether you are looking for a first-time buyer or refinancing your current home, our team in Hamilton will guide you through the process and help you make informed decisions. We work with multiple lenders to ensure that you get access to competitive rates and flexible terms. Our team can also help you with second home mortgage, private and self employed mortgage, bad credit and vacation home loans. We can also connect you with b lenders in Ontario.

Our team of highly rated mortgage brokers in Hamilton is passionate about what they do and have years of experience in the industry. We understand that every individual’s situation is unique, and therefore, we take the time to understand your specific circumstances before providing you with personalized solutions.

Our services are also available for the residents of Kitchener, Burlington, Newmarket, Guelph, Brantford and surrounding cities.

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

We Can Help You Get The Best Rates In Just 3 Minutes

Our broad network of lenders across Canada allows us to secure the best rates for you. But we don’t stop there; we specialize in finding the perfect mortgage product that fits your unique needs. As a leading mortgage broker in Hamilton, we offer impartial advice without the pressure of promoting any particular solution, ensuring your mortgage aligns seamlessly with your financial objectives. Ready to get started? Visit our mortgage calculator to estimate your payments!

Calculate Your Costs Instantly

Why Our Clients Trust Us For Their Mortgage Needs

Expertise Built Over Years in the Industry

Streamlined Pre-Approval Process for Peace of Mind

We recognize that finding your dream home is an exciting journey, and being prepared is key. That’s why we offer a streamlined pre-approval process that enables you to make an offer with confidence. By getting pre-approved, you’ll have a clear understanding of your financial standing and budget, allowing you to shop for your ideal home without any uncertainty. Our efficient approach ensures that you’re always ready when the right opportunity arises.

Proven Success with Over 5,000 Approved Mortgages

A Commitment to Transparency and Trust

Personalized Service Tailored to Your Financial Goals

Every client is unique, and we understand that your financial situation requires a personalized approach. We pride ourselves on offering tailored services that cater to your specific needs. Our team takes the time to listen to your concerns and aspirations, crafting mortgage solutions that perfectly align with your financial objectives. Whether you’re a first-time homebuyer or looking to refinance, we’re here to guide you every step of the way.

With Mortgage Squad, you’re not just getting a mortgage; you’re gaining a partner committed to helping you achieve your homeownership dreams.

Get Started With Our Mortgage Calculator

Not sure where to start? Our mortgage calculator is the perfect tool to help you get an idea of your potential monthly payments and budget. Simply input some basic information about your desired home and financial situation, and our calculator will provide you with an estimated mortgage amount. This allows you to better plan and prepare for your future homeownership journey. You can also reach out to us for our pre-qualification services.

Get Approved

From Mortgage Broker in Hamilton Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Our Agents

Mortgage Broker in Hamilton - Zubair Afzal

Zubair Afzal is the Principal Mortgage Broker in Hamilton & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Hamilton, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Get in Touch Today

FAQs

Working with a mortgage broker can provide you with access to a wider range of lenders and mortgage products, potentially saving you time and money in the long run. A broker can also offer personalized advice and guidance tailored to your specific financial situation.

Working with a mortgage broker can provide you with access to a wider range of lenders and mortgage products, potentially saving you time and money in the long run. A broker can also offer personalized advice and guidance tailored to your specific financial situation.

Mortgage brokers have access to a larger pool of lenders and mortgage products, which could potentially result in better rates for you. Additionally, brokers often have established relationships with lenders and can negotiate on your behalf.

Mortgage brokers are experienced in navigating the mortgage process and can help guide you through the application process. They also have a thorough understanding of lender requirements and can assist in finding a mortgage product that best suits your financial situation.

Having bad credit may make it more challenging to secure a mortgage, but it is not impossible. A mortgage broker can help you explore alternative options and work with lenders who specialize in working with individuals with less-than-perfect credit. They may also be able to provide advice on improving your credit score before applying for a mortgage.

Yes, self-employed individuals can still obtain a mortgage. However, the process may be more complex and require additional documentation to verify income and financial stability. A mortgage broker can assist in navigating this process and finding lenders who cater to self-employed individuals.