Highly Rated

Mortgage Broker in Sault Ste Marie

Our experienced mortgage brokers in Sault Ste Marie are here to understand and meet your specific needs. Explore your options today.

481+

200+

5000+

Mortgage Broker in Sault Ste Marie: Our Range of Products

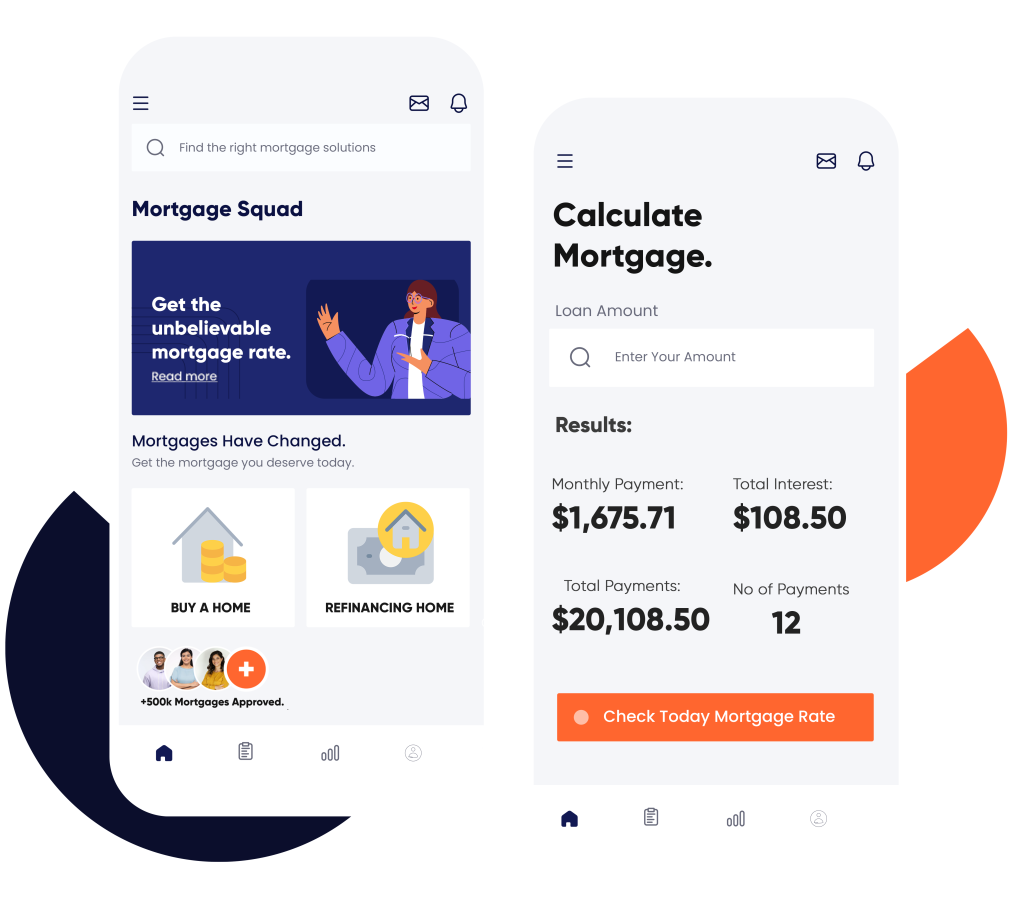

Our team offers a comprehensive suite of mortgage solutions tailored to fit a wide range of needs, including first and second home mortgages designed to guide you through the process of securing your dream property. We also specialize in private mortgages for those looking for flexibility, and we understand the challenges self-employed individuals face, offering custom solutions to meet their unique financial situations. For clients with less-than-perfect credit, our bad credit mortgage options focus on getting you back on track and achieving your homeownership goals.

In addition to home buying, we provide financial tools such as debt consolidation to help manage and reduce high-interest obligations efficiently. Our mortgage refinance and renewal services assist clients in obtaining better rates and terms, saving money in the long term. We also offer assistance with pre-qualification, and offer a mortgage calculator to help you determine your payments. All these services are conveniently available in Guelph, Sudbury, Richmond Hill, St. Catharines, Markham, Cornwall and all nearby cities, ensuring that expert mortgage assistance is just around the corner.

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Why the Residents of Sault Ste Marie Trust Us

Our clients in Sault Ste Marie trust us because of our reputation for excellent customer service and extensive knowledge in the mortgage industry. Our team is committed to providing personalized solutions and exceptional support throughout the entire mortgage process, from initial consultation to closing. As a trusted mortgage broker in Sault Ste Marie, we understand that purchasing a home or refinancing can be overwhelming, so we strive to make it as stress-free as possible by handling all the details and assisting with any questions or concerns along the way. Other than that, we promise:

15+ Years of Experience and Local Knowledge

Competitive Rates and Terms

We understand the importance of finding affordable mortgage rates and terms that meet your financial goals. Our team works tirelessly to negotiate with lenders on your behalf, ensuring that you get the best possible rates and terms for your mortgage.

Calculate Your Costs Instantly

Convenient Services and Tools

Wide Network of Lenders

As an independent mortgage broker in Sault Ste Marie, we have access to a wide network of lenders. This allows us to offer our clients a diverse range of options and find the best fit for their unique needs and circumstances.

As life changes, so do our financial needs. That’s why we offer services for both mortgage refinancing and renewal. Whether you’re looking to consolidate debt, lower your interest rate, or access equity for renovations or investments, we can help you navigate the process and secure the best possible terms for your unique situation. And when it comes time to renew your homeowner’s loan, our mortgage broker in Thunder Bay work with you to find the best options available and ensure that you continue receiving competitive rates and terms.

Pre-Qualification Services You Can Rely On

Our pre-qualification process is thorough and reliable, giving you a clear understanding of your financial standing and potential eligibility for a mortgage. This can help you make informed decisions when it comes to house hunting or considering refinancing options.

Streamlined Documentation and Application Process

Assurance Against Denials

As your mortgage broker in Sault Ste Marie, we offer pre-approval services designed to enhance your chances of obtaining the financing you require. Our team supports you at every stage, ensuring your application stands out to lenders. By creating a compelling submission, we alleviate your concerns about potential loan denials and help you feel more confident during the home-buying process.

Why Should You Choose Us Over Banks?

Banks may have the advantage of being well-known and established financial institutions, but there are several reasons why you should choose our independent mortgage brokerage over them.

Firstly, as mentioned earlier, we have a wide network of lenders at our disposal. This means that we can offer you more options and potentially better rates and terms than what a single bank can offer.

Additionally, our team has specialized expertise in working with self-employed individuals. We understand the unique challenges faced by this group when it comes to securing a mortgage, and we have the experience and knowledge to help you navigate through them successfully.

Moreover, our services are personalized and tailored to your specific needs. When you work with us, you can expect individual attention and a customized approach to finding the right mortgage solution for you.

We also offer flexibility in terms of communication and meetings. Unlike banks, which may have rigid schedules and limited availability, we are committed to being available for our clients at their convenience.

Ultimately, choosing us as your mortgage broker in Sault Ste Marie over a bank means choosing a dedicated team that prioritizes your best interests and works tirelessly to find the best mortgage option for you. With our wide network of lenders, reliable pre-qualification services, specialized expertise, personalized approach, and flexible availability, we are confident that we can provide you with an exceptional mortgage brokerage experience.

Find out more about the differences between mortgage brokers and banks.

Get Approved

From Mortgage Broker in Sault Ste Marie Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Our Agents

Mortgage Broker in Sault Ste Marie - Zubair Afzal

Zubair Afzal is the Principal Mortgage Broker in Sault Ste Marie & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Sault Ste Marie, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Get in Touch

If you’re ready to take the next step in your homeownership journey, we encourage you to get in touch with our team. You can contact us through our website or by giving us a call. Our friendly and knowledgeable staff will be happy to answer any questions you may have and guide you towards the best mortgage solution for your needs.

FAQs

The typical down payment for a mortgage ranges from 3% to 20% of the property’s purchase price. A larger down payment can lower your monthly payments and potentially eliminate private mortgage insurance requirements.

The mortgage approval process can take a few weeks. The timeline depends on factors like the lender’s requirements, the borrower’s financial situation, and the efficiency of document submission.

Pre-qualification is an estimate of what you might be able to borrow based on a preliminary review of your finances. Pre-approval is a more rigorous process that verifies your financial information, giving a more precise account of how much you can borrow.

Improving your credit score, maintaining stable employment, reducing existing debt, and saving for a larger down payment can enhance your likelihood of being approved for a mortgage with favorable terms.