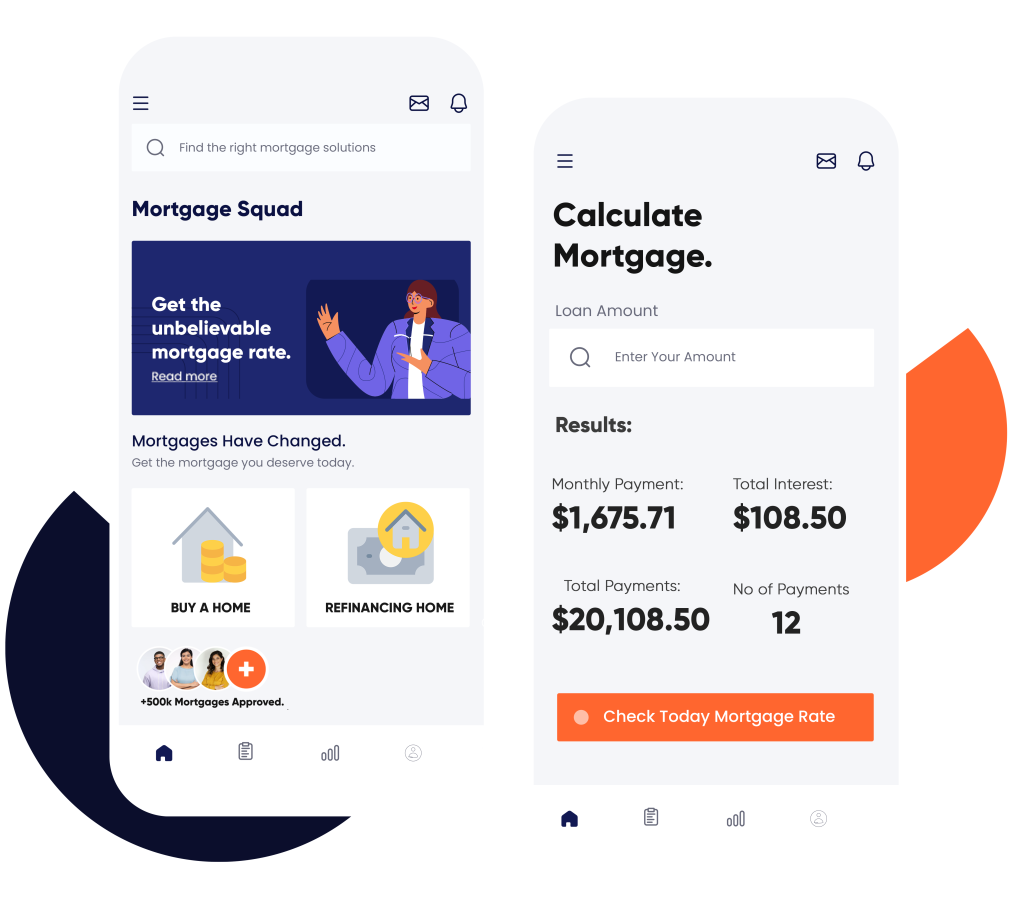

Highly Rated

Mortgage Broker in Markham

Our experienced mortgage brokers in Markham are here to understand and meet your specific needs. Explore your options today.

481+

200+

5000+

The Products We Offer As a Mortgage Broker in Markham

At Mortgage Squad, we offer a wide range of mortgage products and services to suit your individual needs. Our team of experts will work with you every step of the way to find the best solution for your unique situation.

Whether you are searching for a mortgage for your first or second home, our team is dedicated to finding the perfect fit for you. We also specialize in providing private mortgages tailored to your requirements. For those who are self-employed or have a bad credit history, don’t worry — we have options designed to help you secure the mortgage you need. Additionally, we offer services in debt consolidation, helping you streamline your debts into a single manageable payment, and mortgage refinance and renewal solutions to help you save money by securing better interest rates and terms.

Our reach is extensive, offering our expert mortgage broker services not only in Markham, but also in neighboring locations including Windsor, Ottawa, Sault Ste Marie, Niagara Falls, London, and nearby cities. For those looking to invest in a vacation home, we provide dedicated vacation home mortgage services to help make your dreams a reality. Whatever your mortgage needs, our team is committed to providing personalized support and guidance to ensure you find the right mortgage product that aligns with your goals. Explore the possibilities with us and take the next step towards achieving your homeownership and financial aspirations.

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Expertise You Can Count On - 15+ Years of Experience

Established in 2007, our mortgage brokerage has over 15 years of experience in the industry. This means we have the expertise and knowledge to navigate the complex world of mortgages, ensuring you receive top-notch service and advice. Our team stays up-to-date on the latest market trends and changes, allowing us to provide you with accurate and timely information to make informed decisions.

Best Practices to Get You the Best Terms and Rates

As the top mortgage broker in Markham, we are committed to following best practices to help you secure the best possible terms and rates for your mortgage. We work with a wide network of lenders, both traditional banks and alternative lenders, to provide you with a range of options tailored to your unique financial situation. Our team also has strong negotiation skills and will advocate on your behalf to get you the most favorable terms for your mortgage.

Calculate Your Costs Instantly

Flexible Services Tailored to Your Needs

We understand that every client is different and has specific needs when it comes to mortgages. That’s why we offer flexible services tailored to meet your individual requirements. Whether you need assistance with pre-approval, first-time homeowner guidance, or finding a mortgage solution despite less-than-perfect credit, we are here to help. Our team will work with you every step of the way, ensuring your mortgage process is smooth and stress-free.

Wide Network of Lenders

We, as mortgage brokers in Markham, have built strong relationships with a wide network of lenders, giving us access to a variety of mortgage products and options. This allows us to find the best solution for your unique situation, whether you are looking for a fixed or variable rate, traditional or alternative lender, or have specific financial circumstances. With our extensive network, we can provide you with more opportunities and better rates.

Get Approved

From Mortgage Broker in Markham Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Pre-Qualification Services For Your Peace of Mind

Before you start looking for your dream home, it’s important to know how much you can afford. Our pre-qualification services help give you peace of mind and ensure that you are shopping within your budget. We will work with you to determine your maximum loan amount, taking into consideration factors such as income, credit score, and debt-to-income ratio. This way, you can confidently search for a home knowing that it fits within your financial means.

Expert Advice For Every Step of the Process

Continued Support After Closing

Our commitment to our clients doesn’t end after closing on your new home. We understand that life changes and financial needs may arise, which is why we offer ongoing support and guidance even after the mortgage process is complete. Whether you have questions about refinancing or need help with a financial review, we are always available to provide assistance and ensure that your mortgage continues to work for you.

From First Mortgage to Renewal, We Offer It All

First Time Home Buyer’s Mortgage

Purchasing your first home is an exciting milestone, and we are here to make the process as smooth as possible. Our first home buyer’s mortgage options are designed to accommodate the unique circumstances of those entering the housing market for the first time. We offer competitive rates and personalized service to help you confidently take your first steps into homeownership.

Second Home Mortgage

Whether you’re investing in a second property or seeking a seasonal retreat, our second home mortgage solutions can help make your dreams a reality. With flexible terms and expert guidance, we ensure that your financing aligns with your budget and goals, allowing you to secure your additional residence with ease.

Vacation Home Mortgage

Escape to your ideal getaway with our vacation home mortgage options. We specialize in financing for secondary properties, offering competitive interest rates and personalized support. Our team of mortgage brokers in Markham will work closely with you to understand your vacation home aspirations, ensuring a seamless mortgage experience for your serene retreat.

Debt Consolidation

Simplify your finances with our debt consolidation mortgage services, designed to streamline your payments and reduce overall interest costs. Our team will assist you in evaluating your current debt obligations and developing a mortgage plan that consolidates them into a single, manageable monthly payment, enhancing your financial stability and peace of mind.

Construction Mortgage

Building your dream home requires specialized financing, and our construction mortgage offerings provide the flexibility and peace of mind you need throughout the building process. With tailored options to cover both the initial loan for construction and the final mortgage upon completion, our experts support you from groundbreaking to move-in day with transparent and reliable service.

Renewal and Refinancing

As your financial needs evolve, you may find that it’s time to renew or refinance your mortgage. Our team can help you evaluate your current mortgage and determine the best course of action, whether that means negotiating better terms with your current lender or finding a new solution that better suits your goals. With our guidance, you can navigate the renewal and refinancing process with confidence.

Our Agents

Mortgage Broker in Markham - Zubair Afzal

Zubair Afzal is the Principal Mortgage Broker in Markham & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Markham, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Get in Touch Today

No matter your mortgage needs, our team is here to help. Contact us today to schedule a consultation with a mortgage broker in Markham and learn more about how we can support your homeownership goals. With our expertise and personalized approach, you can trust that you are in good hands when it comes to securing a mortgage for your dream home. So, don’t wait any longer – let’s start working towards your homeownership dreams together!

FAQs

The specific documents required may vary depending on your individual situation, but generally you will need to provide proof of income (pay stubs or tax returns), assets (bank statements), debts (credit card bills or loan statements), and identification (government-issued ID). Your mortgage broker can help you determine the exact documents needed for your application.

The length of the mortgage process can vary, but typically it takes around 30-45 days from application to closing. This timeline can be affected by various factors such as property type, credit score, and any complications that may arise during underwriting. Your mortgage broker will keep you updated throughout the process and work to ensure a smooth and timely closing.

Closing costs refer to the fees and expenses associated with finalizing the purchase of a home. These can include appraisal fees, title search and insurance, lawyer fees, government taxes, and more. It’s important to budget for these costs when planning for your mortgage, as they can add up to several thousand dollars. Your mortgage broker can provide an estimate of these costs based on your specific situation and location.