Highly Rated

Mortgage Broker in Kitchener

Our experienced mortgage broker in Kitchener is here to understand and meet your specific needs. Explore your options today.

481+

200+

5000+

Expert Mortgage Broker in Kitchener: Your Guide for Every Property Type

When it comes to choosing a mortgage, you deserve reliable advice from seasoned brokers. Our dedicated team provides comprehensive insights, drawing on our expertise in market trends, rates, and regulations. We’re here to guide you, helping you pay off your mortgage faster and manage your debt wisely.

Whether you’re a first-time homebuyer, looking for a second home mortgage, dealing with bad credit, need a vacation home mortgage, interested in a private mortgage, or seeking mortgage renewal, we’re here to assist you. We understand that the mortgage process can be daunting, but you can rely on us for support every step of the way. We handle all the details, including negotiations with private lenders, to ensure you get the best rates.

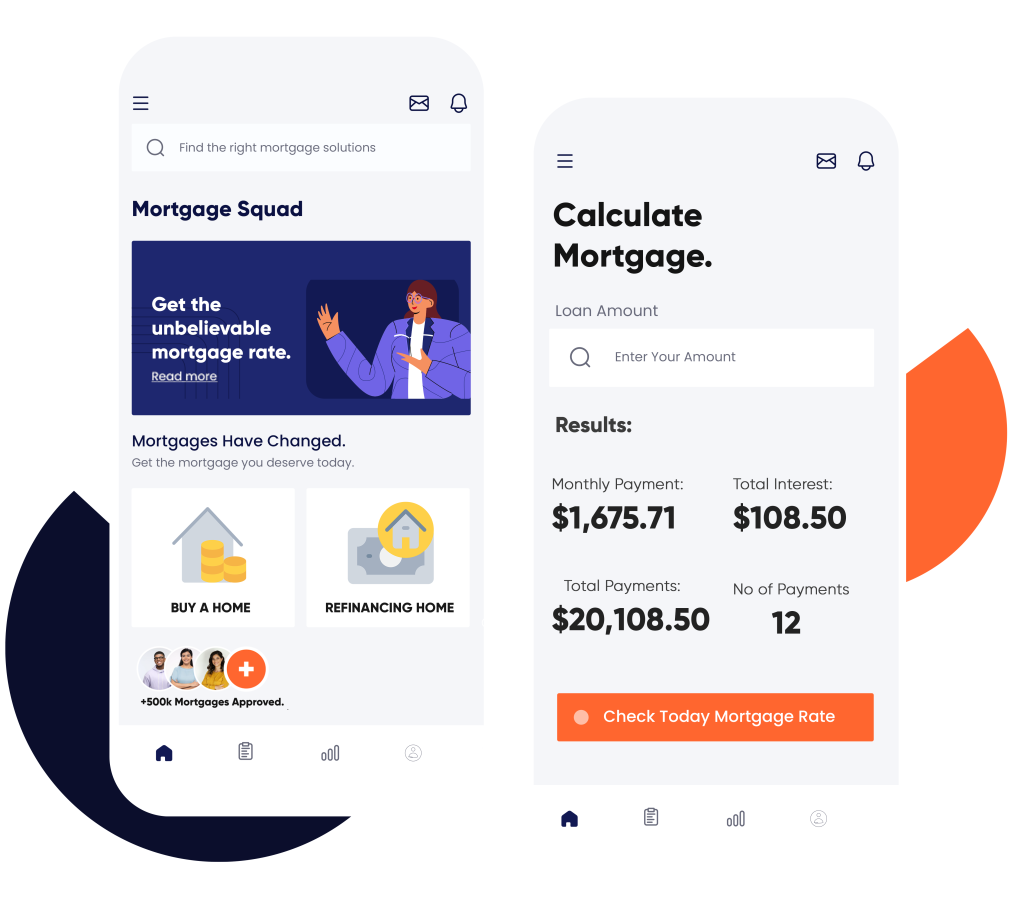

Since we’re not tied to any specific lender or product, we can create customized solutions that suit your unique needs. Our flexibility allows us to compare rates from multiple lenders, helping you find the best available options. Plus, our services extend to areas like Brantford, Oshawa, Sarnia, Guelph, Richmond Hill and surrounding cities. Apply now and receive full support from the top mortgage broker in Kitchener today. Your dream home is closer than you think! And don’t forget to check out our mortgage calculator to kick off your journey!

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Secure the Best Rates With Us

Looking to secure the best mortgage rates and options? Our team of expert mortgage agents is here to help! We collaborate closely with lenders to find you the most competitive deals, saving you thousands and simplifying the entire mortgage process.

As a leading mortgage broker in Kitchener, we equip you with the vital information needed to make informed choices. By comparing rates from top financial institutions, we tailor solutions to meet your specific needs. Our services not only save you valuable time but can also lead to substantial savings on your mortgage over the years.

Calculate Your Costs Instantly

What Sets Us Apart from Banks and Traditional Brokerages?

We prioritize transparency and integrity above all else. We believe that building lasting relationships with our clients is crucial for success. That’s why we take the time to get to know your individual financial aspirations and create customized solutions that truly fit your needs. Unlike larger banks and brokerages focused on sales quotas and commissions, we are dedicated solely to finding the perfect mortgage option for you.

Additionally, we take pride in being accessible. Our dedicated team is here to answer any questions or concerns you may have throughout your mortgage journey. We understand that dealing with mortgages can be daunting, and we are committed to making the process as seamless and stress-free as possible. Trust us to be your reliable mortgage broker in Kitchener, guiding you every step of the way.

Learn more about the key differences between brokers and banks.

Reasons Why Kitchener Homeowners Trust Us

We are proud to have earned the trust of homeowners in Kitchener and surrounding areas. Here’s why our clients choose us time and time again:

- Experience That Counts: With over 15 years of collective expertise in the real estate sector, our team has successfully assisted countless Kitchener homeowners in securing their ideal homes or refinancing existing properties. Rely on our deep knowledge to navigate any complexities and tailor solutions to your unique circumstances.

- Local Insight: As a local mortgage broker in Kitchener, we possess an in-depth grasp of the Kitchener housing landscape. This insight empowers us to offer valuable guidance on market trends, enabling you to make well-informed financing decisions.

- Tailored Approach: We recognize that each homeowner’s financial journey is distinct. That’s why we take a personalized approach, collaborating closely with you to understand your objectives and design a customized solution that aligns with your specific needs.

- Wide Access to Lenders: As an independent mortgage broker in Kitchener, we have connections with a diverse array of lenders and products. This advantage allows us to explore options and secure the most favorable rates and terms for you.

- Pre-Qualification and Approval: Our pre-approval process simplifies your home purchase journey, providing you with a clear idea of the financing options available to you. This puts you in a better position to make informed decisions and minimizes any surprises down the road.

- Commitment to Transparency: We prioritize transparency throughout the entire process. From clarifying fees and charges to providing timely updates on your application’s status, we ensure clear communication and complete understanding every step of the way.

Whether you’re embarking on your first home purchase or considering refinancing your mortgage, you can count on us for expert guidance and personalized service. Our mission is to make your experience as seamless and stress-free as possible, allowing you to focus on what truly matters — finding your dream home. Reach out to us today to discover how we can help you achieve your homeownership aspirations!

Get Approved

From Mortgage Broker in Kitchener Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Our Agents

Mortgage Broker in Kitchener - Zubair Afzal

Zubair Afzal is the Principal Mortgage Broker in Kitchener & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Kitchener, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Get in Touch

FAQs

Yes, you can still work with a mortgage broker even if you have bad credit. Brokers have access to a wide range of lenders and can help you find one that is willing to work with your credit score. They may also be able to provide advice on how to improve your credit in order to secure better mortgage terms.

The specific documents required may vary depending on the lender, but generally, you will be asked for proof of income, employment verification, bank statements, and details about any assets or liabilities. Your broker can guide you through the necessary documentation and make sure everything is accurate and complete before submitting your application.

In addition to helping clients find the right lender and securing competitive rates, mortgage brokers may also offer services such as credit counselling, debt consolidation, and financial planning. They can be a valuable resource for overall financial guidance and support throughout the home buying process and beyond.