Highly Rated

Mortgage Broker in Sarnia

Our experienced mortgage brokers in Sarnia are here to understand and meet your specific needs. Explore your options today.

481+

200+

5000+

Mortgage Broker in Sarnia: Our Diverse Range of Products

We offer a diverse range of mortgage products to cater to the unique needs of our clients in Sarnia. From first-time homebuyers to seasoned investors, we have a solution for everyone.

Our comprehensive offerings include products designed for first and second home mortgages, accommodating a wide range of situations and financial backgrounds. We understand that every client is unique, which is why we also cater to individuals with bad credit, providing tailored solutions to help achieve homeownership goals. For those who are self-employed, our specialized products simplify the process, ensuring you can maximize your financial potential. Additionally, we offer private mortgage options that provide more flexibility compared to traditional lending sources.

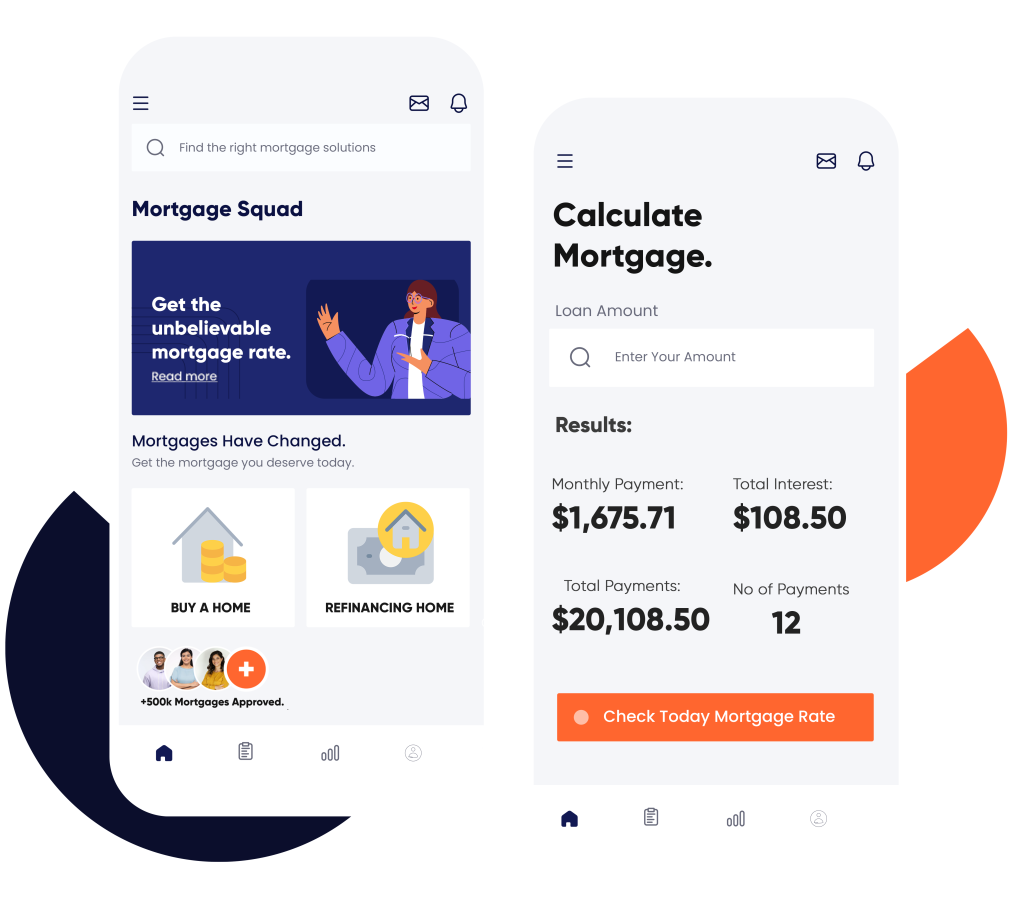

Beyond these possibilities, our services extend to debt consolidation, helping you streamline expenses and improve financial health. A home equity line of credit can also be a beneficial financial tool, offering you access to funds as needed. To assist our clients further, we provide a user-friendly mortgage calculator to empower you with information regarding potential payments. Plus, our pre-qualification services help streamline the home buying process, giving you a clear idea of your purchasing power upfront. Our team is committed to supporting you at every step of your journey, and our services are available for the residents of Oshawa, Thunder Bay, Niagara Falls, Barrie, Guelph, Vaughan and nearby cities.

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Expert Advice Every Step of the Way

As a mortgage broker in Sarnia, we understand that buying or refinancing a home can be overwhelming and stressful. That’s why our team is dedicated to providing expert advice every step of the way. We will guide you through the entire process, from pre-approval to closing, and answer any questions you may have along the way.

Save Time and Money with our Brokerage Services

We are a highly-rated brokerage serving the residents of Sarnia, with access to a wide network of lenders and can negotiate on your behalf to secure the best rates and terms for your mortgage. This means that not only will you save time shopping around for different lenders, but you could also potentially save thousands of dollars over the course of your home loan.

A Personalized Approach

We understand that every client’s financial situation is unique, which is why we take a personalized approach to each individual. As a trusted mortgage broker in Sarnia, our team will work closely with you to understand your goals, needs, and budget in order to find the best mortgage solution for you. We value open communication and will keep you informed throughout the entire process.

Calculate Your Costs Instantly

Explore Your Mortgage Options Today

If you’re looking to purchase a new home or refinance your current one in Sarnia, look no further than our mortgage brokerage. With our range of products, expert advice, personalized approach, and commitment to client satisfaction, we are confident that we can help you find the perfect mortgage solution for your needs. We believe in fostering long-term relationships with our clients. Even after securing a mortgage, we will continue to be a resource for you, providing support and guidance whenever needed.

With an excellent reputation as a mortgage broker in Sarnia, we also understand that the home financing process can be daunting, especially for first-time homebuyers. That’s why we offer educational resources and workshops to help educate our clients about mortgages and the real estate market.

Our goal is not just to secure a home loan for you, but to empower you with knowledge so you can make informed decisions throughout the process.

Additionally, we are committed to staying current with industry trends and updates, ensuring that our clients receive the most up-to-date information and advice. Our team of experienced professionals is always striving to improve our services and provide an exceptional experience for every client.

Client Satisfaction is Our Priority

Client satisfaction is our top priority. We strive to provide exceptional service and support to our clients, making the home financing process as smooth and stress-free as possible. With our expertise and commitment, we have helped countless clients achieve their homeownership dreams. Let us help you too.

Before you start your home search or consider refinancing, it’s important to know your budget and what you can afford. That’s where our pre-qualification services come in. By assessing your financial situation, credit history, and other factors, we can provide you with an accurate estimate of how much you may be qualified to borrow. This information will help guide your home search and give you confidence when negotiating with sellers.

Not only does pre-qualification give you a better understanding of your budget, but it also shows sellers that you are a serious buyer who is ready to make an offer. In a competitive real estate market like Sarnia, this can give you an edge over other potential buyers.

Get Approved

From Mortgage Broker in Sarnia Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Our Agents

Mortgage Broker in Sarnia - Zubair Afzal

Zubair Afzal is the Principal Mortgage Broker in Sarnia & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Sarnia, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Join Our Growing Community

We invite you to join our growing community of satisfied clients. Let us help you navigate the complex world of mortgages and make your dream of homeownership a reality. Contact our mortgage brokers in Sarnia today to learn more about our services and how we can assist you in finding the perfect solution for your unique situation.

FAQs

Mortgage brokers often have access to a wider range of lenders and products compared to banks. This can give you more options and potentially save you money in the long run. Additionally, brokers work on your behalf to find the best mortgage solution for your specific needs, while banks may only offer their own limited products. Find out more about the differences between banks and mortgage brokers.

Yes, you can still use a broker if you have bad credit. They will work with you to understand your financial situation and find lenders who are willing to work with borrowers in similar circumstances. A broker can also provide advice on steps you can take to improve your credit score and increase your chances of getting approved for a mortgage.

When choosing a broker for your home loan, it’s important to do your research and consider factors such as their experience, reputation, and the lenders they have access to. It’s also helpful to read reviews or ask for referrals from friends or family members who have recently gone through the home buying process. Communication is another key factor – you want a broker who is responsive and keeps you informed throughout the entire process.

After choosing a mortgage lender through your broker, you will begin the application process. This typically involves submitting all necessary documentation, such as income verification and credit reports. The lender will then review this information and determine if you are eligible for a loan and at what interest rate. During this time, it’s important to keep in touch with your broker and provide any additional information or documentation as needed.