Highly Rated

Mortgage Broker in Oshawa

Our experienced mortgage brokers in Oshawa are here to understand and meet your specific needs. Explore your options today.

481+

200+

5000+

Extensive Services Offered by the Leading Mortgage Broker in Oshawa

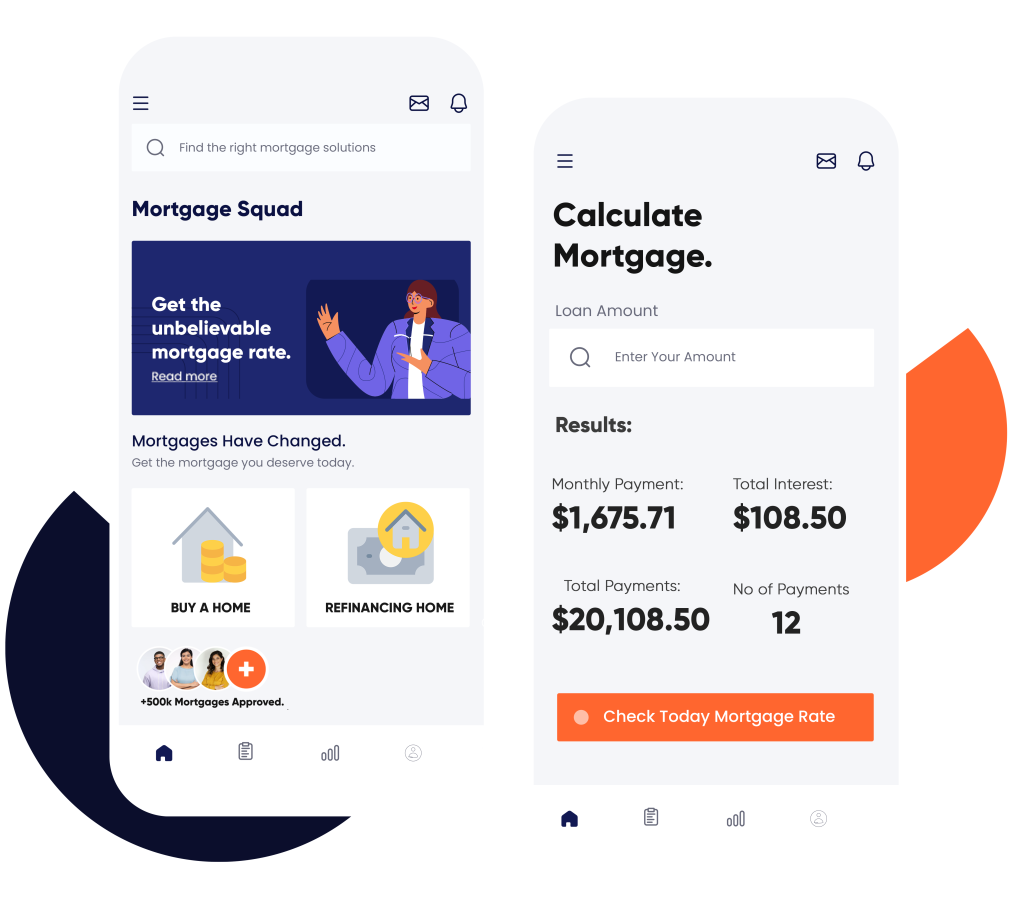

At Mortgage Squad, we take pride in being one of Oshawa’s leading mortgage brokers, with over 15 years of industry experience under our belt. Our strong connections with a diverse range of lenders allow us to offer a variety of mortgage solutions tailored to meet your specific needs. Whether you’re a first-time home buyer, looking to refinance, or need assistance with bad credit, we’re here to provide reliable options that align with your financial goals.

Our mission is to simplify your journey to homeownership and financial stability. Explore our user-friendly mortgage calculator and count on our expert team for guidance every step of the way.

Let’s turn your dream of owning a home into reality!

What differentiates us in the Oshawa mortgage scene is our extensive network of lenders. This allows us access to competitive rates and exclusive deals that you might not find through traditional means. Whether you’re self-employed, seeking a construction mortgage, or looking for home loan options from B lenders, we’ve got you covered.

We also serve clients in Oakville, Brampton, Thunder Bay, St. Catharines, Sarnia and nearby areas. Don’t hesitate—reach out to us today to get started on your mortgage application!

Promotions

Pre Qualify in Minutes

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

VIP REALTOR PROGRAM

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

LEGAL FEE PROGRAM

FREE LEGAL FEE PROGRAM - A $1000 VALUE

Mortgage Broker Services We Provide in Oshawa

First Mortgage

Embarking on your journey to homeownership? Whether you’re a first-time buyer or ready to upgrade, our first mortgage options feature competitive rates and flexible terms specifically designed to help you secure that dream home. We take a personalized approach, carefully evaluating your financial situation to match you with lenders that suit your unique needs. Our dedicated team is here to ensure a seamless and stress-free experience, allowing you to focus on making cherished memories in your new place.

Second Mortgage

Need extra cash for renovations, education, or other expenses? Our second mortgage options offer the financial flexibility you’re looking for. By leveraging your home equity, you can access the funds necessary to achieve your aspirations. Whether your goal is to enhance your living space, invest in personal growth, or manage unforeseen costs, our customized solutions are designed to help you reach those goals with confidence and ease. Let us help you unlock your home’s potential!

Mortgage Renewal

As your mortgage term nears its end, our dedicated team is ready to assist you with the renewal process. Being a mortgage broker in Oshawa, we focus on securing the most favorable terms, ensuring you continue to benefit from competitive rates while navigating any changes in your financial landscape. Whether you want to adjust your payment plan or need guidance on your options, we’re here to support you at every stage to ensure you get the best possible deal.

Mortgage Refinance

Looking to lower your monthly payments or tap into your home’s equity? Our refinancing solutions are crafted to help you meet your financial objectives. Whether you’re seeking to escape high-interest rates, free up cash for investments, or simplify your expenses, we’re committed to walking you through each step of the refinancing journey. Let us help you find tailored solutions that maximize your financial future.

Mortgage Calculator

To facilitate your decision-making, we offer a user-friendly mortgage calculator. This handy tool helps you estimate monthly payments and explore various scenarios so you can find the best fit for your budget and lifestyle.

Private Mortgage

If securing a traditional home loan is proving challenging, we provide alternative options, including private mortgages tailored for those with unique financial situations. Our goal is to empower you with access to funding, regardless of the hurdles posed by conventional lending practices.

Pre-Qualification Services

Curious about your mortgage eligibility? Our pre-qualification services help you understand the potential options available to you. This includes assessing your credit score, analyzing your debt-to-income ratio, and exploring various loan products to determine which ones align best with your financial goals.

Calculate Your Costs Instantly

What Makes Us the Top Mortgage Broker in Oshawa?

Effortless Paperwork

We get it — sorting through piles of paperwork can be a real headache. At Mortgage Squad, we simplify the process by handling all the intricacies for you. Our mission is to ensure a smooth, stress-free experience from beginning to end, allowing you to concentrate on what truly matters: settling into your new home.

Confidence with Pre-Approval

We know that the thought of mortgage denial can be intimidating. That’s why, as one of Oshawa’s most trusted brokers, we offer a pre-approval process designed to boost your confidence.

By evaluating your financial situation upfront, we help reduce risks and steer you in the right direction toward obtaining the financing you need, ensuring you feel supported throughout the journey.

Tailored Loan Terms

Thanks to our extensive network of reliable lenders, we’re in a prime position to negotiate the best terms for your home loan. Our skilled team is committed to discovering a plan that perfectly fits your individual financial goals and situation, so you can rest easy knowing you’re getting the best deal customized just for you.

Customized Solutions for Your Needs

We aim to be your top choice for a mortgage broker in Oshawa. Our goal is to make the entire process as easy and stress-free as possible for every client. We offer personalized service and expert guidance tailored to your specific needs. Whether you’re a first-time buyer, considering refinancing, or renewing your home loan, our dedicated team is here to assist you every step of the way. Check out our wide range of options designed to help you achieve your homeownership dreams!

Get Approved

From Mortgage Broker in Oshawa Today

First mortgages, 2nd mortgages, Home Equity Lines of Credit, Purchases & Rescue Financing — We Will Help!

- +1 (905) 553-8550

Same day pre-approvals and quick closings!

Our Agents

Mortgage Broker in Oshawa - Zubair Afzal

Zubair Afzal is the Principal Mortgage Broker in Oshawa & Director at Mortgage Squad. With over 19 years of experience in the real estate industry. His expertise spans across various domains, including residential and commercial mortgage lending, and real estate. With a strong background in real estate and a deep understanding of Oshawa, Zubair is dedicated to providing high-quality service and personalized solutions to his clients. He is recognized for his commitment to excellence, having received honors such as the Entrepreneur of the Year 2012 and the Centurion Award.

Get in Touch Today

Ready to take the next step toward your financial goals? Contact us today to book a consultation and start your journey to securing your home loan with Mortgage Squad. Your dream home is closer than you think!

FAQs

Pre-qualification is like a quick snapshot of your financial situation based on the info you provide. On the other hand, pre-approval involves a deeper dive where lenders verify your financial details and evaluate your creditworthiness, giving you a conditional promise regarding your home loan amount.

Your ability to afford a home hinges on your income, expenses, and any current debts. It’s vital to review your budget and consider additional costs like taxes, insurance, and maintenance. Partnering with our team can help you establish a realistic budget for your home purchase.

Refinancing means replacing your current home loan with a new one, often to secure a lower interest rate, adjust the loan duration, or unlock equity in your property. Our team can help you identify when refinancing is a smart move and guide you through the entire process.

Your credit score plays a significant role in determining the interest rate you’ll get and your eligibility for various products. Generally, higher credit scores lead to better terms, so it’s wise to maintain a strong credit history.

Absolutely! There are several options available for those making lower down payments, including programs for first-time homebuyers. We’re here to help you explore these options and find what works best for you.

Typically, you’ll need to provide proof of income, tax returns, bank statements, and identification. Our team will give you a detailed checklist to ensure you have everything required for a hassle-free application experience.